MB-310 Practice Exam Free – 50 Questions to Simulate the Real Exam

Are you getting ready for the MB-310 certification? Take your preparation to the next level with our MB-310 Practice Exam Free – a carefully designed set of 50 realistic exam-style questions to help you evaluate your knowledge and boost your confidence.

Using a MB-310 practice exam free is one of the best ways to:

- Experience the format and difficulty of the real exam

- Identify your strengths and focus on weak areas

- Improve your test-taking speed and accuracy

Below, you will find 50 realistic MB-310 practice exam free questions covering key exam topics. Each question reflects the structure and challenge of the actual exam.

A client has unique accounting needs that sometimes require posting definitions. You need to implement posting definitions. In which situation should you implement posting definitions?

A. when financial dimensions need to default from the vendor record onto an invoice

B. when only certain dimensions are allowed to post with certain main account combinations

C. when creating multiple balanced ledger entries based on transaction types or accounts

D. when the system needs to automatically post a transaction to the accounts receivable account on invoice posting

A company provides employee life insurance to all full-time employees. Employee life insurance policies are paid twice a year to the insurance company. Transactions for current employees must be recognized in the general ledger twice a month with an employee's pay. Transactions for new employees must be recognized in the general ledger based upon the employee's first pay date. You need to configure accrual schemes for the new fiscal year. Which two configurations should you use? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. For new employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

B. For current employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the employee’s first pay date.

C. For new employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the employee’s first pay date.

D. For current employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

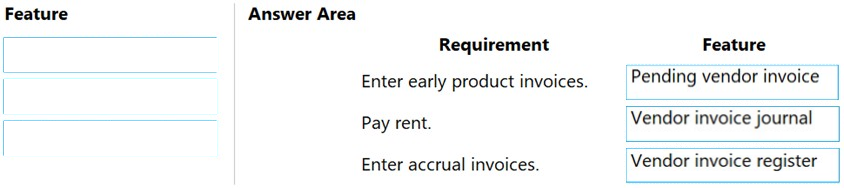

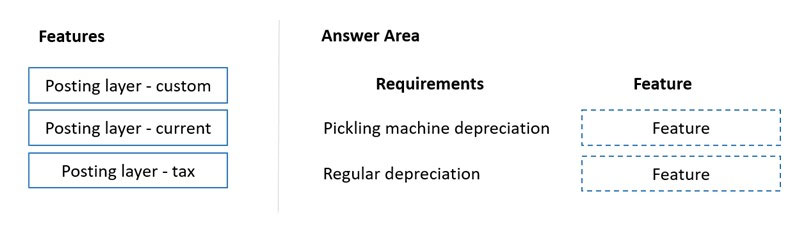

DRAG DROP - You need to configure the system to meet invoicing requirement. Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

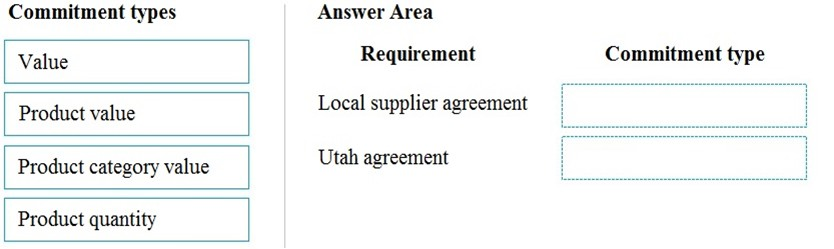

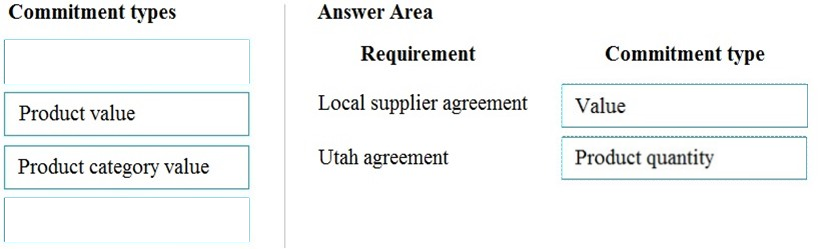

DRAG DROP - You need to configure the system to for existing purchasing contracts. Which commitment types should you use? To answer, drag the appropriate commitment types to the correct requirements. Each commitment type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

The JAX sales tax group include the following tax codes: • Jacksonville • Duval CT • FL • FL Special 1 • FL Special 2 • FL Special 3 • FL Special 5 The default item sales tax group includes the following tax codes: • Jacksonville • Duval CT • FL • FL Special 1 • FL Special 2 • FL Special 3 • FL Special 4 • Lake Worth • Palm Beach CT You assign the JAX sales tax group as the sales tax group, and default item sales tax group on the sales order. You need to select the tax code used for tax calculation on the sales order. What should you choose?

A. Jacksonville -Duval CT -FL -FL Special 1 -FL Special 2 -FL Special 3 -FL Special 4 -Lake Worth -Palm Beach CT

B. Jacksonville -Duval CT -FL -FL Special 2 -FL Special 3 -FL Special 5

C. Jacksonville -Duval CT -FL -FL Special 1 -FL Special 2 -FL Special 3

D. Jacksonville -Duval CT -FL -FL Special 1 -FL Special 2 -FL Special 3 -FL Special 5

You need to configure the posting groups for Humongous Insurance s subsidiary. Which ledger posting group field should you use?

A. Sales tax payable

B. Sales tax receivable

C. Customer case discount

D. Use tax payable

E. Use tax expense

You use Dynamics 365 Finance. Your company offers cash discounts. The discounts are offered sequentially to specific customers. Customers must pay their invoices within a specified time period. The cash discounts are as follows: • 5D10% - Cash discount of 10 percent when the amount is paid within 5 days. • 10D5% - Cash discount of 5 percent when the amount is paid within 10 days. • 14D2% - Cash discount of 2 percent when the amount is paid within 14 days. Cash discounts can only be given if the payments are made within 10 days. You need to configure cash discounts. What should you do?

A. Create a new cash discount code of 14D10%.

B. Create a new cash discount code of 10D14%.

C. Delete the 14D2% cash discount code.

D. Delete the 14D2% cash discount code from the next discount code list value of 10D5%.

HOTSPOT - A company implemented Dynamics 365 Finance less than a year ago. A departments have exceeded their fiscal year budgets. The following business rules must be implemented to keep the company’s spending on budget. • Operations must be allowed to exceed budget. • Marketing must receive warnings when they are over budget. • Sales mast not exceed its budget. • All departments must have a calculation in place to determine what they can spend. • Budget funds do not need to be recorded in the general ledger. You need to configure budget controls. Which configuration option should you use? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review. You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller s needs. Which functionality should you configure?

A. an Advanced ledger entry workflow that uses the organizational hierarchy for journal posting, associated with the Advanced ledger journal name

B. an alert that is sent to the controller when a journal name is created

C. a manual journal approval with the journal assigned to the controller’s user group

D. the controller’s security role so that he has approval privileges for General ledger journals

A United States-based company uses Dynamics 365 Finance to collect and report sales tax. The company has a main account for each state where they collect and report sales tax. The system must transfer the tax liability for each state to their respective main account automatically every month when they run the settle and post sales tax process. You need to configure Dynamics 365 Finance. What should you do?

A. Create a sales tax settlement period for each state.

B. Select a vendor account during the sales tax group setup.

C. Create a sales tax ledger posting group for each state. Associate a settlement account to a main account for vendor accounts in the vendor posting profile.

D. Create a sales tax authority for each state and associate the authority with the respective main account.

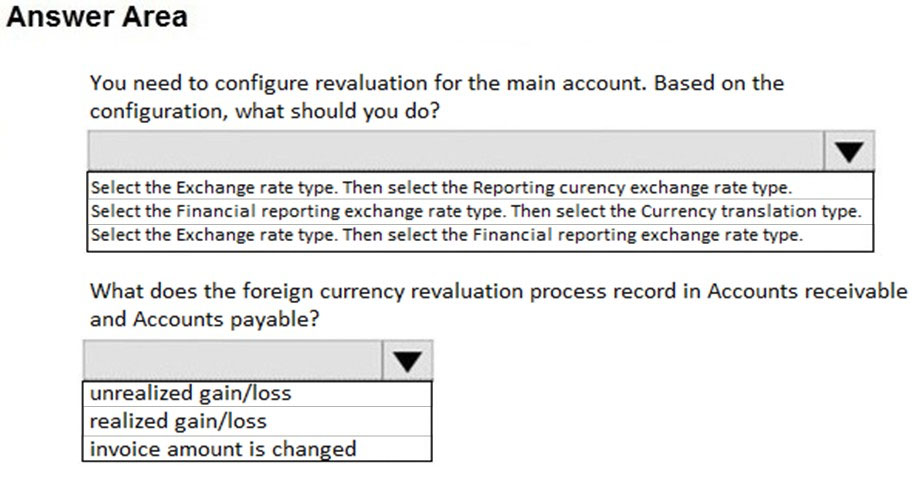

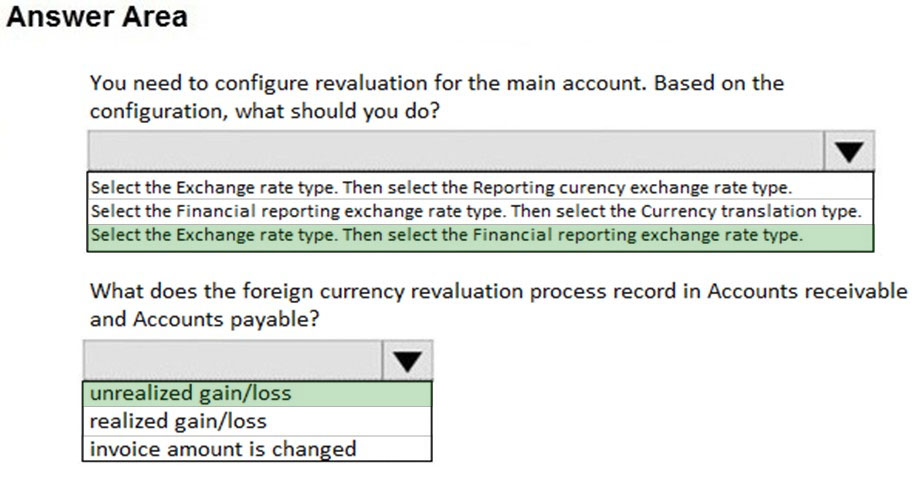

HOTSPOT - You are asked to configure foreign currency revaluation in Dynamics 365 Finance. You are viewing the main accounts.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

You are configuring intercompany accounting for a multicompany enterprise. You need to set up the Due to and Due from accounts. Which main account type should you use?

A. Profit and loss

B. Expense

C. Balance sheet

D. Liability

E. Asset

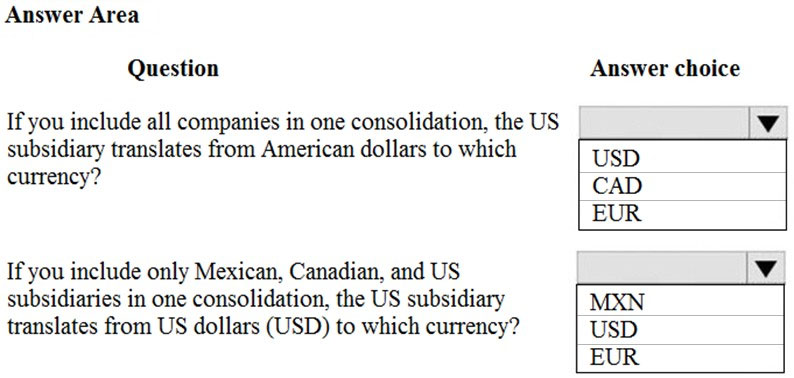

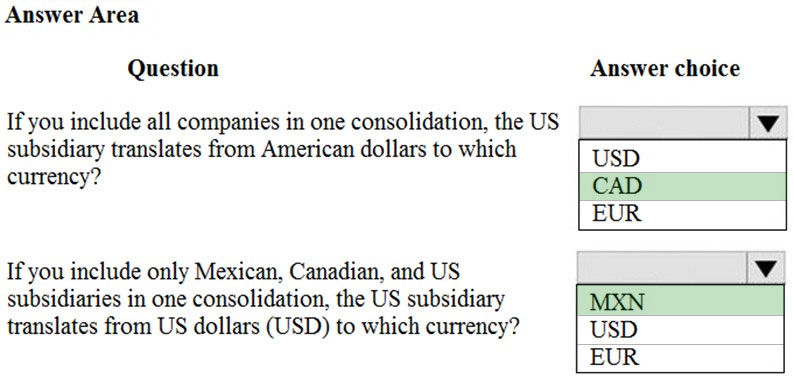

HOTSPOT - You need to set up legal entity currencies and conversions in Dynamics 365 Finance. You review the hierarchy for consolidation of multiple legal entities.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

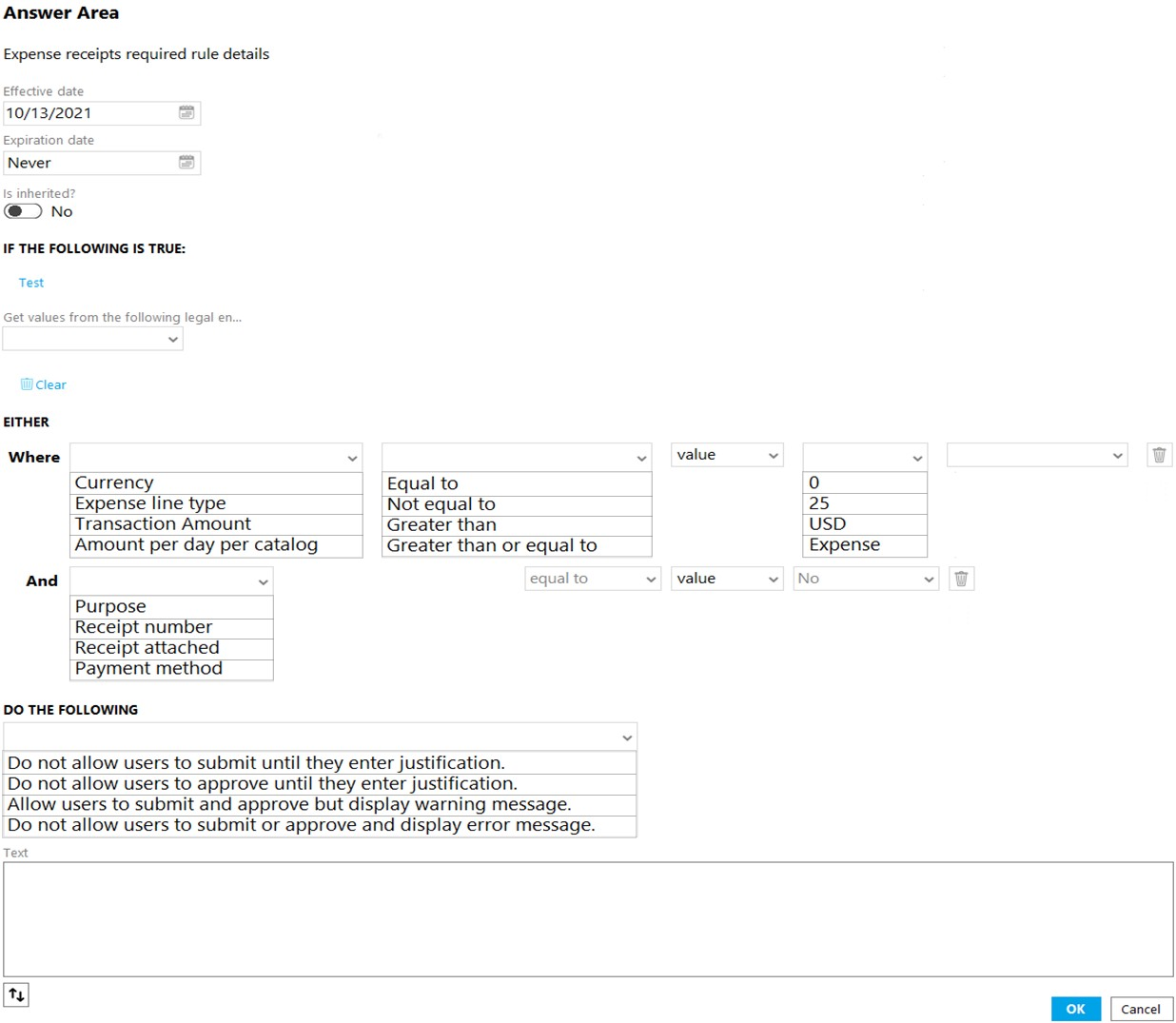

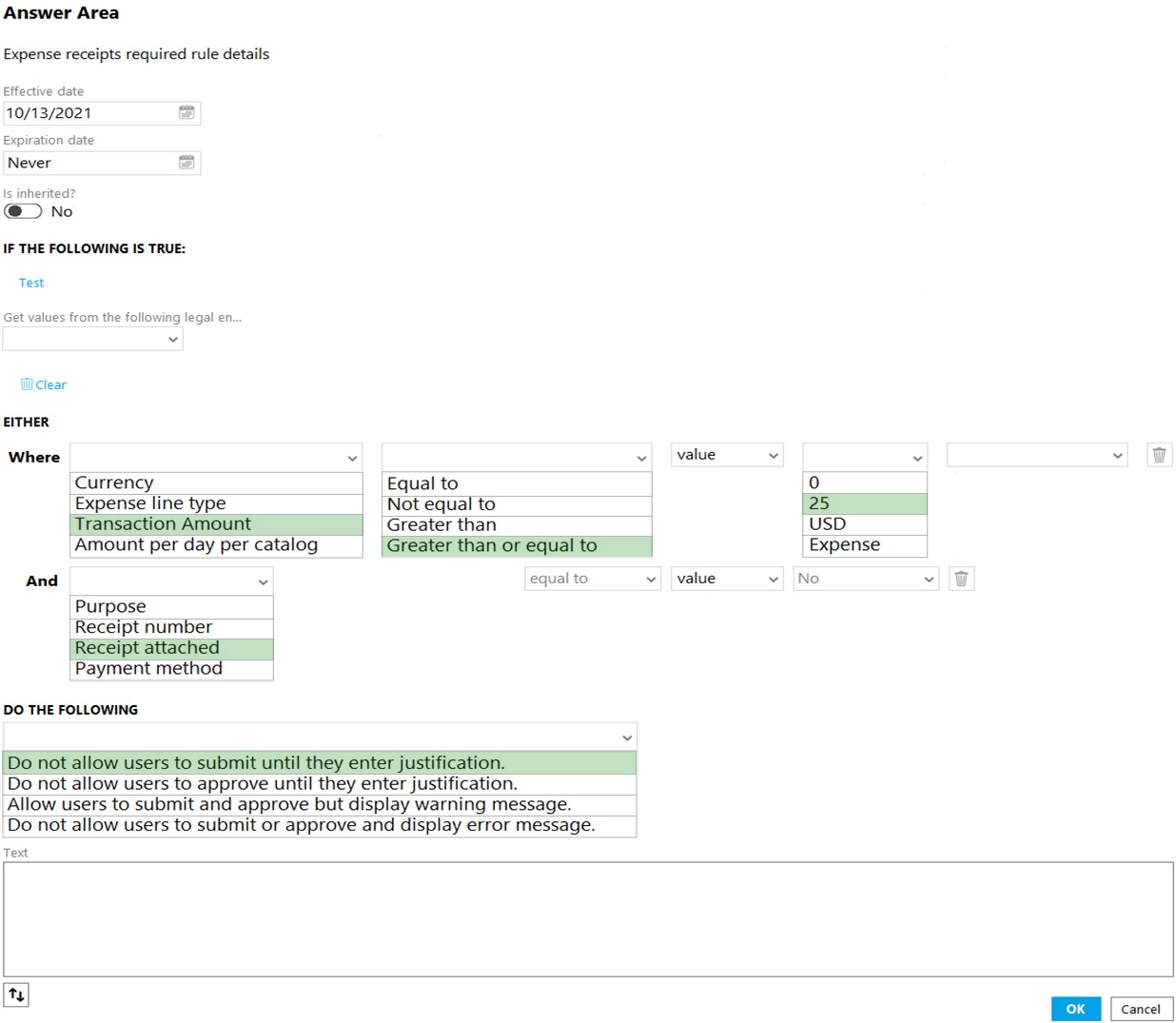

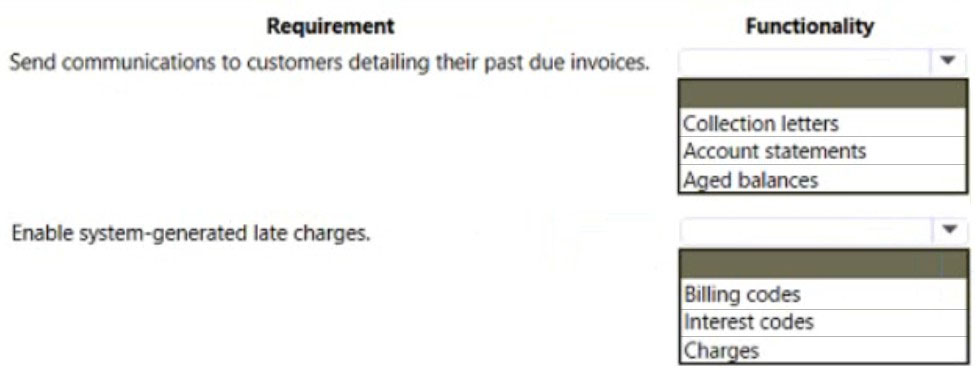

HOTSPOT - A company uses Dynamics 365 Finance. The company requires a receipt for any employee expense that is $25 of more. You need to configure an expense management policy. How should you configure the expense receipt required rule detail? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

A legal entity has locations and customers in multiple states within the United States. You need to ensure that taxable customers are charged sales tax for taxable items in their delivery location. Which three settings must you configure? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. the Sales tax group on the Customer record

B. the Terms of delivery setup

C. the Item Sales tax group on the Item record

D. the Sales reporting codes

E. the Sales tax codes

Manual entry of currency exchange rates must be discontinued. Currency exchange rates must use the current rate values provided by the European Central Bank. The exchange rate entries and updates must be automated. You need to configure the system. Which two options should you use? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Configure the exchange rate provider

B. Run currency revaluation

C. Create the currencies

D. Configure dual currency

E. Run the import currency exchange rate process

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions. The client has the following requirements: ✑ Only expense accounts require dimensions posted with the transactions. ✑ Users must not have the option to select dimensions for a balance sheet account. You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry. Solution: Configure default financial dimensions on expense accounts only. Does the solution meet the goal?

A. Yes

B. No

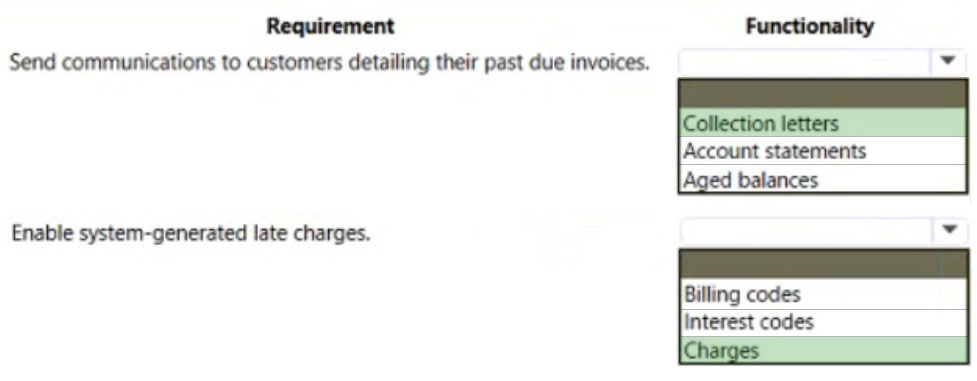

DRAG DROP - You need to select the functionality to meet the requirement. Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

You are configuring budgeting components in Dynamics 365 Finance. You need to configure multiple budgets. What are three budgeting options you can use? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Cost management budget, including Production and Resource groups

B. Sales budget, including Campaigns and Events

C. Workforce budget, including Compensation groups and Positions

D. Project budget, including Items and Fees

E. Ledger budget, including Revenue and Expense types

A client wants Dynamics 365 Finance to calculate sales tax on a sales order line once an item is added. The sales tax group is already populated with a value. You need to ensure that the sales tax will calculate. Which field should you populate?

A. sales tax code

B. item group

C. customer address

D. item sales tax group

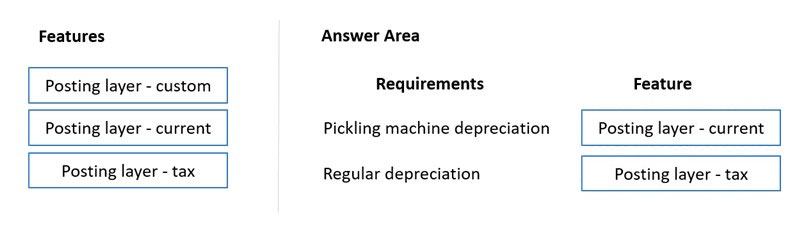

HOTSPOT - You are implementing Dynamics 365 Finance. You must manage aging customer balances by sending communications to the customers detailing their past due invoices and automatically including a late charge. You need to configure Dynamics 365 Finance functionality. How should you configure the functionality? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

You need to configure the system to meet the fiscal year requirements. What should you do?

A. Add an additional fiscal year.

B. Divide the twelfth period.

C. Add an additional period to ledger calendars.

D. Create a closing period.

E. Create a new fiscal calendar.

You are the controller of a multi-entity organization that uses the same chart of accounts and fiscal periods across all entities. You use the financial report designer in Dynamics 365 Finance to create, maintain, deploy, and view financial statements. You need to generate consolidated financial statements by using a building block group to aggregate data across companies and financial dimensions. Which three actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Create a column definition and use the period and year to map the appropriate periods for each company.

B. Create a row definition that includes all appropriate accounts in all companies in the rows.

C. Create a column definition that includes a financial dimension column for each company.

D. Create a reporting tree that includes a reporting node for each company.

E. Use the Reporting Unit field to select the tree and reporting unit for each column.

An exchange rate provider has been configured for Dynamics 365 Finance. Foreign currency transactions using the Euro and the US dollar use a fixed exchange rate for European Central Bank holidays and all days between April 1 and June 30. Foreign currency transactions from March 1 to June 30 fail to post. You need to reconfigure the system to post transactions for this period. Which two configuration changes should you make to the ledgers? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Add a key named FloatCurrencies and set the value to True.

B. Set Create necessary currency pairs to True.

C. Set Import as of start date to Apr01.

D. Add a key named BaseCurrency and value of USD.

E. Set Prevent import on national holiday to True.

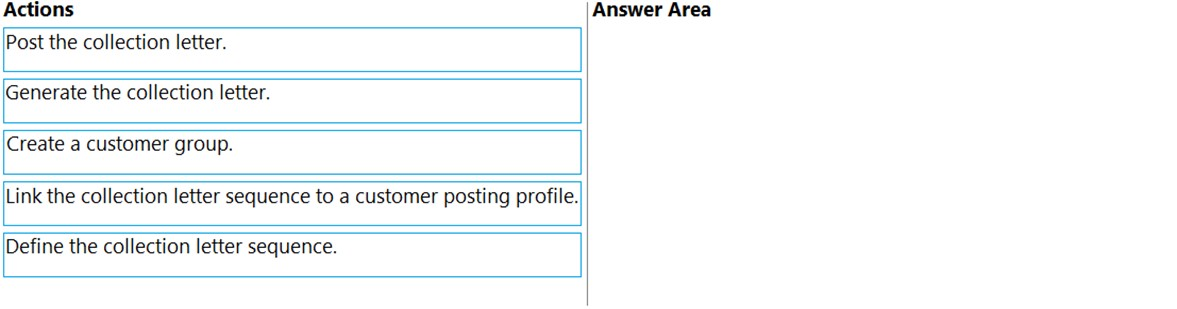

DRAG DROP - You manage customer credit and collections in a Dynamics 365 Finance implementation. At the beginning of each month, you must send collection letters to customers whose payments are overdue. You need to configure the collection letter functionality. Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

A client uses the standard trial balance in Dynamics 365 Finance. The client has the following requirements: ✑ ability to run the trial balance by main account, department, and division ✑ ability to run the trial balance by just main account and department You need to ensure that these options are visible in the trial balance report parameters. What should you configure?

A. ledger validation

B. financial dimensions for department and division

C. financial dimension sets

D. account structure

A company uses Microsoft Dynamics 365 Finance and Dynamics 365 Project Operations. The company must be able to estimate the costs of a project and create a fixed asset by using the project cost estimate. You need to ensure that the company can create a fixed asset from a project. Which project type should you use?

A. Time and material

B. Cost

C. Internal

D. Investment

E. Fixed price

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which tasks can this vendor perform?

A. Request a new user account for a contact person by using the Provision user action.

B. Maintain vendor collaboration invoices.

C. Delete any contact person that they have created.

D. View and modify contact person information, such as the person’s title, email address, and telephone number.

Case study - This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided. To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study. At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section. To start the case study - To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question. Background - First Up Consultants is a global engineering and consulting organization based in Atlanta. The organization assists customers with various implementation projects. The organization provides both consulting services and custom software development. First Up Consultants was recently acquired by a Canadian engineering firm that uses Dynamics 365 Finance. The firm requires First Up Consultants to transition to the solution by 2022. First Up Consultants employs consultants that travel globally, which requires extensive expense management capabilities. First Up Consultants offers software as a service (SaaS) products to customers by using monthly and quarterly subscriptions. Current environment. Travel and expense The company is currently in Phase 2 of their Dynamics 365 Finance implementation. • Consultants submit all travel receipts by using inter-office mail to the team admin for processing, but First Up Consultants wants to modernize this experience. • Expense reports are manually approved and signed by the employee’s manager. Current environment. Finance - • First Up Consultants operates on a 4-5-4 calendar. • Accounting for revenue has been difficult with the SaaS offerings. This has led to implementing Dynamics 365 Finance Revenue recognition. • Revenue recognition has been live for 3 months. • Adatum Corporation pays quarterly for use of the First Up Consultants web design application, starting from the day of use. • Fourth Coffee pays monthly for use of the First Up Consultants photograph editing application with a contract starting August 1 and payment starting September 1. • Adventure Works Cycles pays per use of the First Up Consultant video platform. • A blocking rule is set up to prevent a sales order from processing if a customer exceeds a credit limit. • Customer credit is set up at the account level for VanArsdel, Ltd. • Tailspin Toys is owned by Wingtip Toys. The companies have a credit limit of $60.000 and $100,000, respectively. Current environment. Revenue allocation The company reports the following revenue allocation percentages:Current environment. Tax - VAT tax recovery is required for eligible international business trip expenses. Bank reconciliation is manual and performed by using monthly mailed account statements. The company collects sales taxes from the following states:

Requirements - Travel and expense - • First Up Consultants requires that employees start using corporate cards for all travel expenses. • All expenses over $50 require a receipt. • Beer cannot be expensed. • Employees may use the corporate card for personal expenses during work travel, but expenses must be categorized correctly. • Client entertainment expenses totaling more than $250 must be audited. • Employees require a mobile expense experience. • Expense report entries must be validated when a transaction line is entered. • Employees require the ability to capture receipts by using a mobile device. • First Up Consultants requires the ability to reimburse employees in their paychecks for expenses incurred on personal cards. Financials - • A virtual thirteenth month is required for year-end transactions. • Each day, a validation file must go to First Up Consultants bank detailing all vendor checks paid. • Except fees, all matched transactions must clear automatically during bank reconciliation. • The accounts payable team must verify expense reports prior to posting. • Only payables are allowed to be posted to a prior period up to seven days into the new period. Issues - • User1 installed the Expense Management Service add-in and implemented the auto-match and create expense from receipt features, but the receipt images do not match the corporate card transactions. • Employee1 submits an expense report for a business trip to Europe, but the report is not visible on the expense tax recovery page. • Employees provided feedback that the system lets them know of an expense report policy violation only after the entire expense report is submitted. • Members of the finance department observe sales orders that posted into a closed period. • The finance team observed that for sales order invoice 1234, the price incorrectly posts to a revenue account when it should be deferring. • Employee2 purchased supplies for a holiday party and needs to be reimbursed. • A customer orders software licenses for the offices in Tennessee and Alabama. • Expense reports for unapproved items are posting. • VanArsdel, Ltd. exceeded its credit limit but the sales order was processed. • Tailspin Toys purchases $70,000 in custom software development. You need to address the employees issue regarding expense report policy violations. Which parameter should you use?

A. Validate expense purpose

B. Evaluate expense management policies

C. Policy rule type

D. Pre-authorization of travel is mandatory

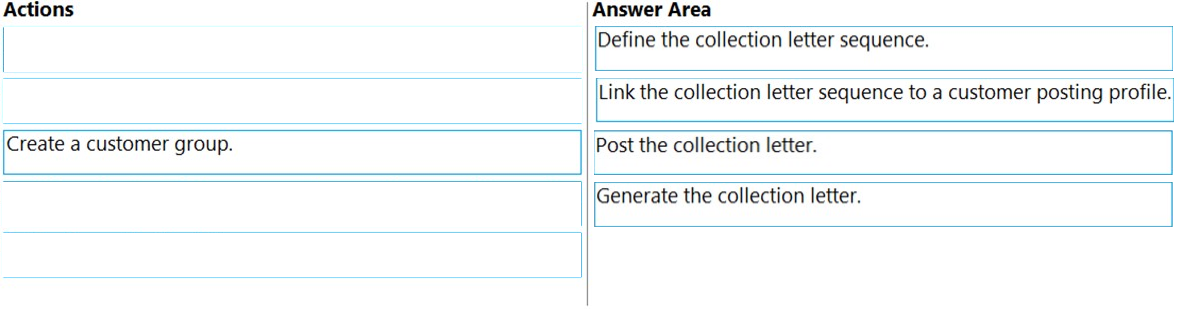

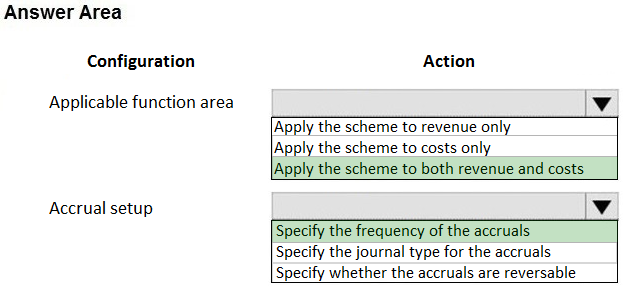

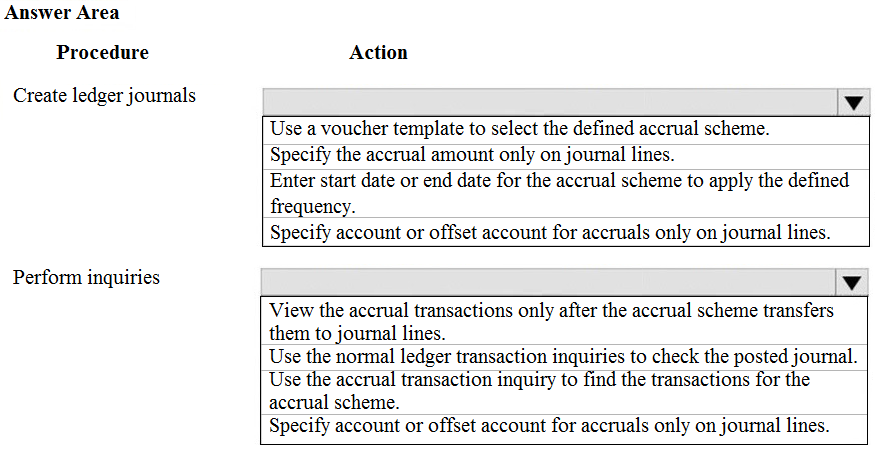

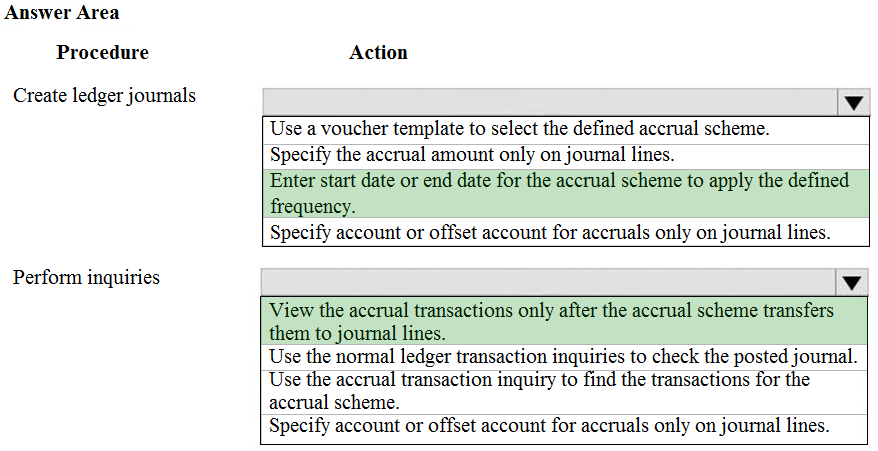

HOTSPOT - A rental service company hires you to configure their system to implement accrual schemes. You need to configure the accrual schemes for the company for both rentals and associated expenses. Which configuration and transaction options should you use? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

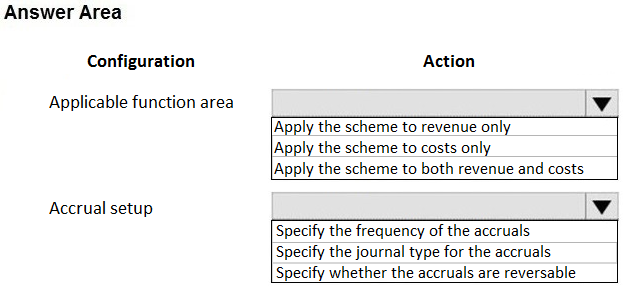

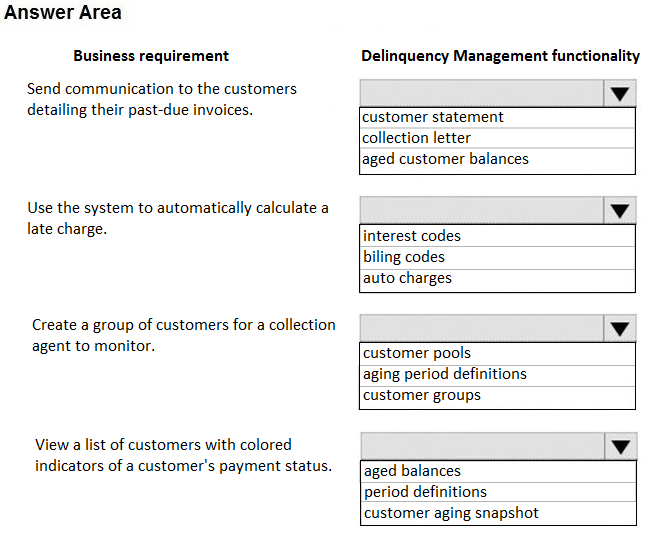

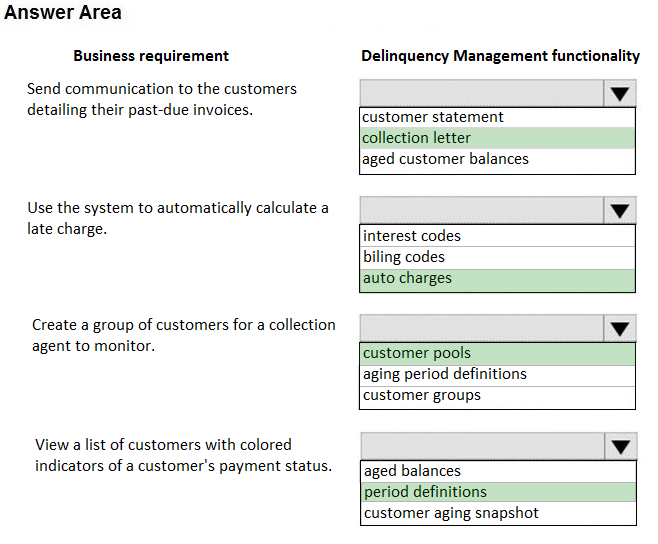

HOTSPOT - A company has delinquent customers. You need to configure Dynamics 365 Finance to meet the following requirements: ✑ Send communication to the customers detailing their past-due invoices. ✑ Use the system to automatically calculate a late charges. ✑ Create a group of customers for a collection agent to monitor. ✑ View a list of customers with colored indicators of a customer's payment status. You need to associate the correct system functionality to manage delinquent customers based on these business requirements. Which functionality should you use? To answer, select the appropriate configuration in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

HOTSPOT - A company uses Dynamics 365 Finance. The company includes six departments that participate in the budget planning process. The finance department generates a previous year budget scenario. You must generate a new baseline scenario that is based on the previous year’s budget scenario. Department managers must be able to enter their budget requests in the baseline scenario. All department requests must be made available to the finance department so that they can determine the total budget funds requested and approve the budget scenario. You need to configure the allocation schedule. How should you configure the schedule for the baseline scenario? To answer, select the appropriate options in the dialog box in the answer area. NOTE: Each correct selectin is worth one point.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A company is preparing to complete yearly budgets. The company plans to use the Budget module in Dynamics 365 Finance for budget management. You need to create the new budgets. Solution: Create budget plans for multiple scenarios. Does the solution meet the goal?

A. Yes

B. No

You need to adjust the sales tax configuration to resolve the issue for User3. What should you do?

A. Create multiple settlement periods and assign them to the US tax vendor.

B. Create multiple sales tax remittance vendors and assign them to the settlement period.

C. Run the payment proposal to generate the sales tax liability payments.

D. Create a state-specific settlement period and assign the US tax vendor to the settlement period.

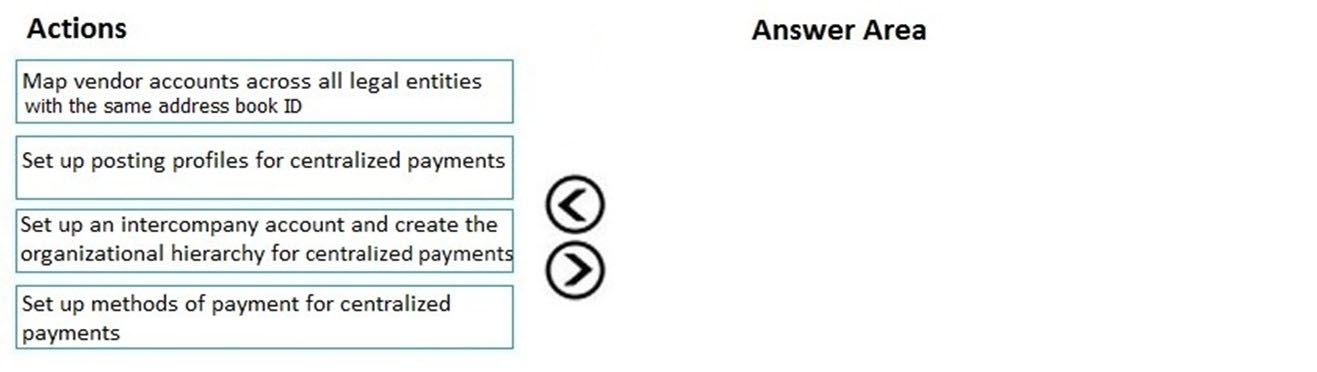

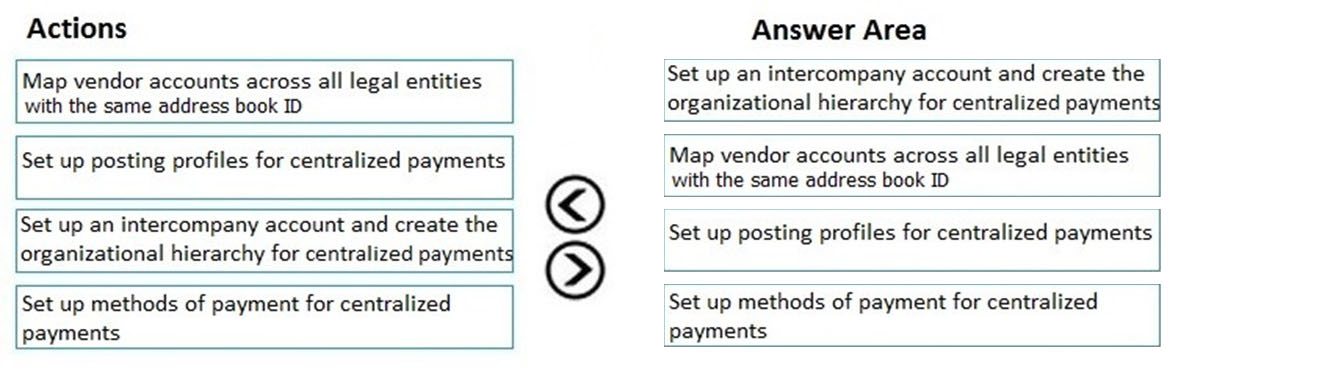

DRAG DROP - You are a Dynamics 365 Finance functional consultant. A legal entity processes and settles vendor payments on behalf of other legal entities in an organization. You need to configure the centralized payment flow for the legal entity. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order. NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select. Select and Place:

You need to configure Accounts Receivable to take pre-orders. Which feature should you use?

A. Settle cloud transactions

B. Accounting source explorer

C. Settle open transactions

D. Customer aging report

E. Voucher transactions

A client is implementing Accounts payable. The client wants to establish three-way matching for 100 of their 5,000 stocked items from a specific vendor. The client requires the ability to have items that require only two-way matching and specific items that require three-way matching. You need to configure the system in the most efficient manner to achieve these requirements. What should you do?

A. Configure a company matching policy of a three-way match

B. Configure a company matching policy of non-required and specify the items that require a three-way match

C. Configure a company matching policy of two-way matching and set the matching policy for specific item and vendor combination level to three-way matching

D. Configure a company matching policy of two-way matching and specify the items that require a three-way match

E. Configure a company matching policy of two-way matching and specify the vendors that require a three-way match

A company plans to allocate revenue across occurrences by using recognition basis. Which recognition basis can you use?

A. Median price

B. Revenue schedule

C. First of next month

D. Monthly

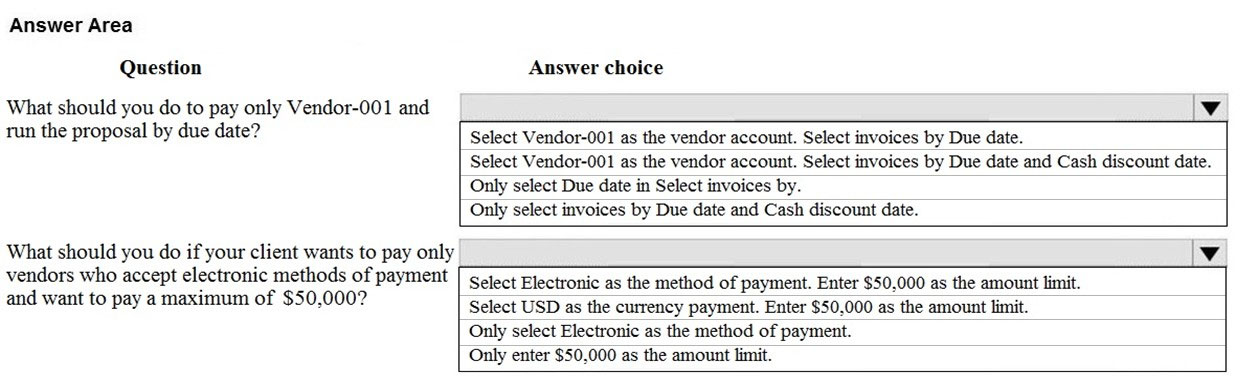

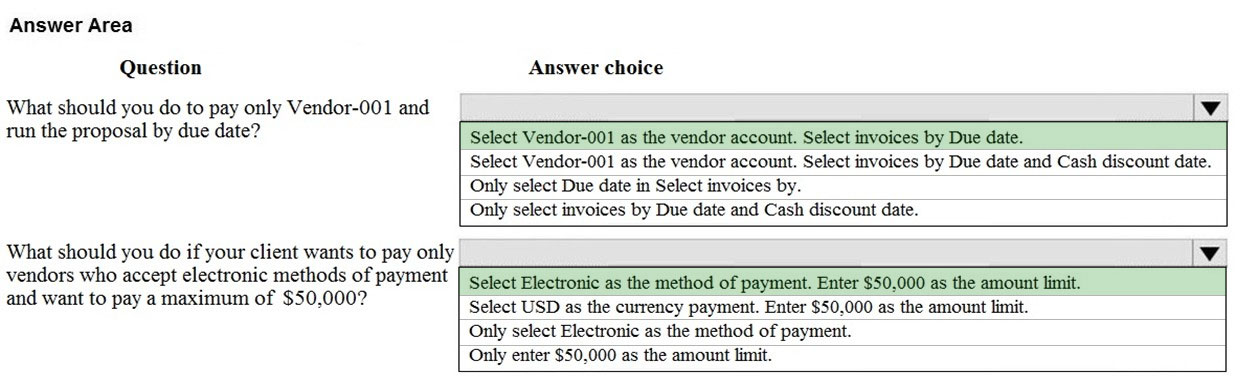

HOTSPOT - You are creating a payment proposal that shows invoices that are eligible to be paid. You display the Accounts payable Payment proposal screen from the Accounts payable payment journal.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

HOTSPOT - A rental service company with complex accrual requirements has accrual schemes set up in its implementation. You need to ensure that all transactions for the company use an accrual scheme. Which actions should you perform? To answer, select the appropriate configuration in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

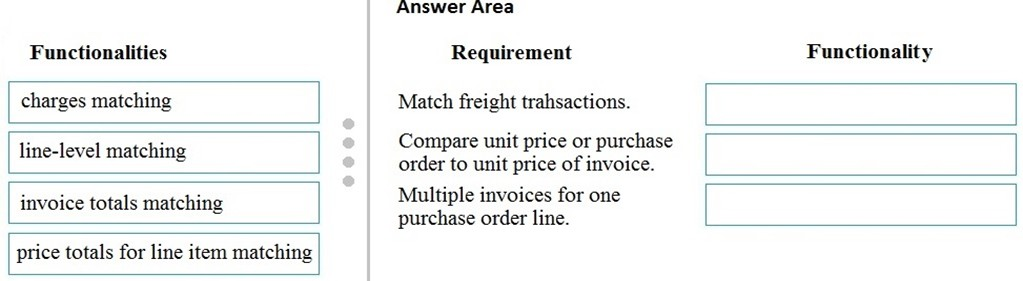

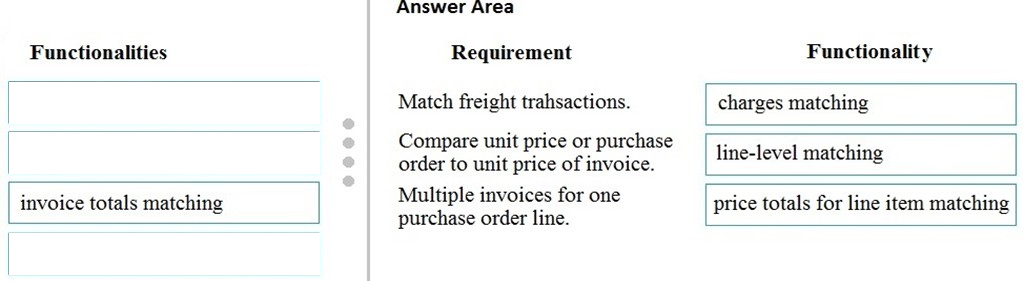

DRAG DROP - A client wants to use Dynamics 365 Finance invoice validation functionality. You need to recommend the invoice validation functionality that meets their requirements. Which functionality should you recommend for each requirement? To answer, drag the appropriate functionality to the correct requirement. Each functionality may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

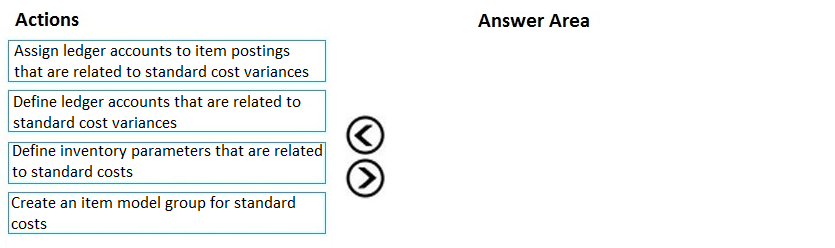

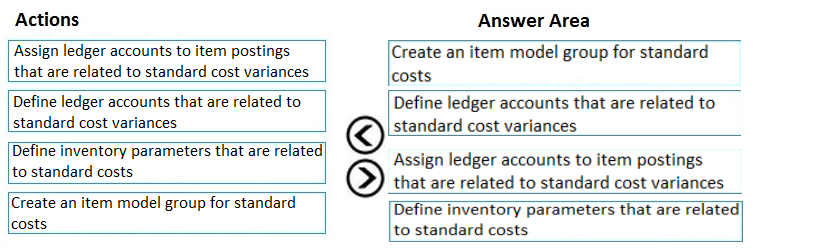

DRAG DROP - You need to set up a process of tracking, recording, and analyzing costs associated with the products or activities of a nonmanufacturing organization. You need to configure the prerequisite setup for the standard costing version for the current period. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

An organization uses Dynamics 365 Finance. Several posted journal entries contain invalid main account and dimension combinations. This leads to incorrect financial reporting. You need to prevent these invalid combinations. What should you do?

A. Configure the account structure to specify which financial dimensions are valid for which main accounts.

B. Train users to select the Validate button in the current journal configuration so that the correct account and dimension combination is used.

C. Configure financial dimension sets to limit which financial dimensions are valid for which main accounts.

D. Associate the correct main accounts to that financial dimension on the financial dimension setup form.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions. The client has the following requirements: ✑ Only expense accounts require dimensions posted with the transactions. ✑ Users must not have the option to select dimensions for a balance sheet account. You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry. Solution: Configure one account structure for expense accounts and apply advanced rules. Does the solution meet the goal?

A. Yes

B. No

DRAG DROP - A company uses Dynamics 365 Finance for expense management. The company has multiple legal entities and multiple departments. Each department may have a different expense policy that may conflict with the legal entity expense policy. You need to configure prioritization of department expense policy over legal entity expense policy. Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

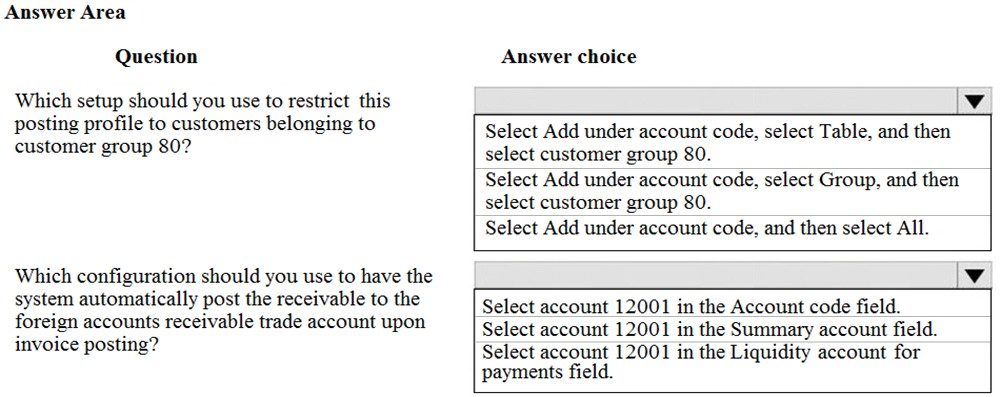

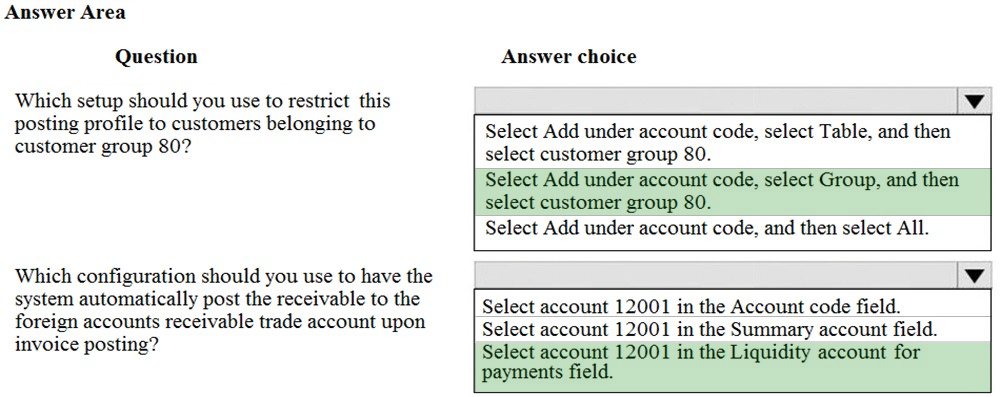

HOTSPOT - A client is using Dynamics 365 Finance for sales order processing and accounts receivable. The client has two customer groups and two Accounts receivable trade accounts. Foreign customers in Group 80 are assigned to account 12001. Domestic customers in Group 40 are assigned to account 12000. You are viewing the client's current setup of Customer posting profiles.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

You are configuring the basic budgeting for a Dynamics 365 Finance environment. You need to configure the types of entries allowed. Which two configurations can you use? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. The budget register entry journals require both Expense and Revenue amount types.

B. Budget register entry line needs a main account and amount to be valid.

C. Budget register entry journals must be allocated across all fiscal periods.

D. Budget register entry lines must select only one account structure.

E. The budget register entries can contain either Expense or Revenue amount types.

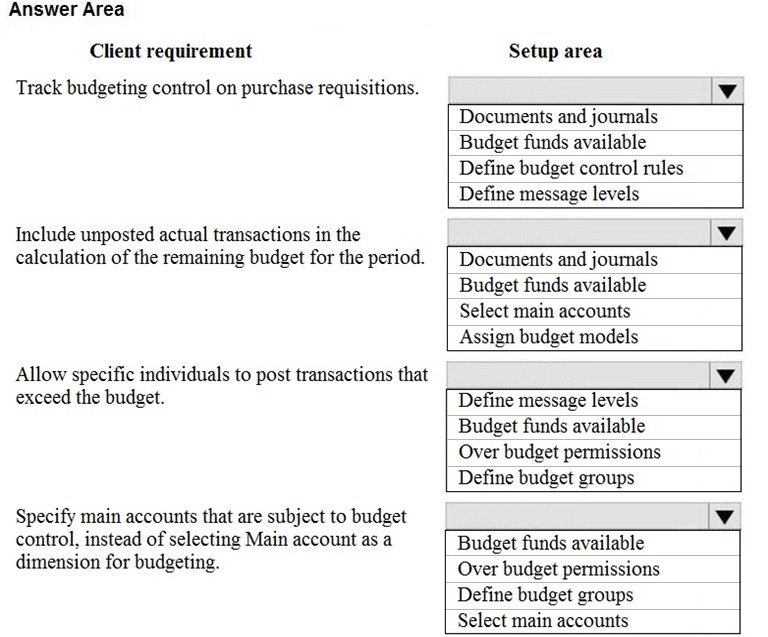

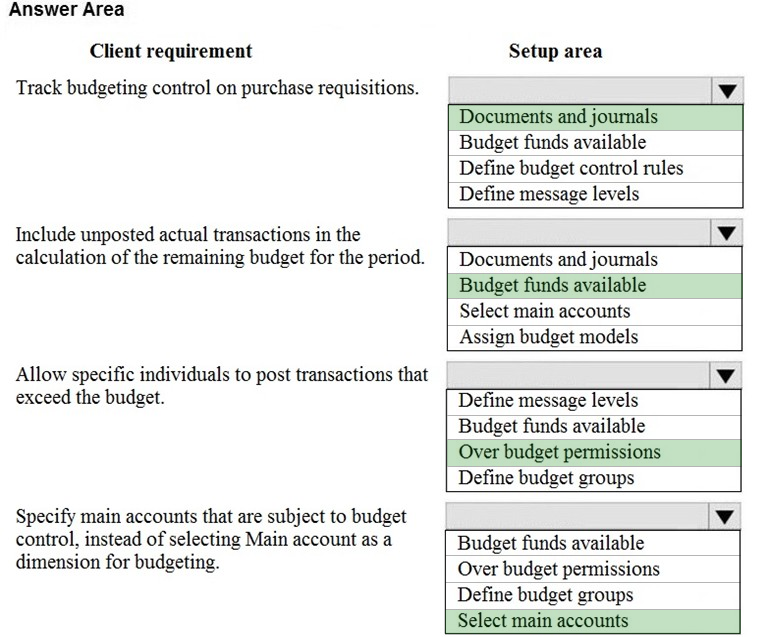

HOTSPOT - A client is implementing the Budgeting module in Dynamics 365 Finance. You need to configure the correct budget control area to meet the client's requirements. ✑ Track budgeting control on purchase requisitions. ✑ Include unposted actual transactions in the calculation of the remaining budget for the period. ✑ Allow specific individuals to post transactions that exceed the budget. ✑ Specify main accounts that are subject to budget control, instead of selecting Main account as a dimension for budgeting. What should you configure? To answer, select the appropriate configuration in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

HOTSPOT - Case study - This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided. To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study. At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section. To start the case study - To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question. Background - First Up Consultants is a global engineering and consulting organization based in Atlanta. The organization assists customers with various implementation projects. The organization provides both consulting services and custom software development. First Up Consultants was recently acquired by a Canadian engineering firm that uses Dynamics 365 Finance. The firm requires First Up Consultants to transition to the solution by 2022. First Up Consultants employs consultants that travel globally, which requires extensive expense management capabilities. First Up Consultants offers software as a service (SaaS) products to customers by using monthly and quarterly subscriptions. Current environment. Travel and expense The company is currently in Phase 2 of their Dynamics 365 Finance implementation. • Consultants submit all travel receipts by using inter-office mail to the team admin for processing, but First Up Consultants wants to modernize this experience. • Expense reports are manually approved and signed by the employee’s manager. Current environment. Finance - • First Up Consultants operates on a 4-5-4 calendar. • Accounting for revenue has been difficult with the SaaS offerings. This has led to implementing Dynamics 365 Finance Revenue recognition. • Revenue recognition has been live for 3 months. • Adatum Corporation pays quarterly for use of the First Up Consultants web design application, starting from the day of use. • Fourth Coffee pays monthly for use of the First Up Consultants photograph editing application with a contract starting August 1 and payment starting September 1. • Adventure Works Cycles pays per use of the First Up Consultant video platform. • A blocking rule is set up to prevent a sales order from processing if a customer exceeds a credit limit. • Customer credit is set up at the account level for VanArsdel, Ltd. • Tailspin Toys is owned by Wingtip Toys. The companies have a credit limit of $60.000 and $100,000, respectively. Current environment. Revenue allocation The company reports the following revenue allocation percentages:Current environment. Tax - VAT tax recovery is required for eligible international business trip expenses. Bank reconciliation is manual and performed by using monthly mailed account statements. The company collects sales taxes from the following states:

Requirements - Travel and expense - • First Up Consultants requires that employees start using corporate cards for all travel expenses. • All expenses over $50 require a receipt. • Beer cannot be expensed. • Employees may use the corporate card for personal expenses during work travel, but expenses must be categorized correctly. • Client entertainment expenses totaling more than $250 must be audited. • Employees require a mobile expense experience. • Expense report entries must be validated when a transaction line is entered. • Employees require the ability to capture receipts by using a mobile device. • First Up Consultants requires the ability to reimburse employees in their paychecks for expenses incurred on personal cards. Financials - • A virtual thirteenth month is required for year-end transactions. • Each day, a validation file must go to First Up Consultants bank detailing all vendor checks paid. • Except fees, all matched transactions must clear automatically during bank reconciliation. • The accounts payable team must verify expense reports prior to posting. • Only payables are allowed to be posted to a prior period up to seven days into the new period. Issues - • User1 installed the Expense Management Service add-in and implemented the auto-match and create expense from receipt features, but the receipt images do not match the corporate card transactions. • Employee1 submits an expense report for a business trip to Europe, but the report is not visible on the expense tax recovery page. • Employees provided feedback that the system lets them know of an expense report policy violation only after the entire expense report is submitted. • Members of the finance department observe sales orders that posted into a closed period. • The finance team observed that for sales order invoice 1234, the price incorrectly posts to a revenue account when it should be deferring. • Employee2 purchased supplies for a holiday party and needs to be reimbursed. • A customer orders software licenses for the offices in Tennessee and Alabama. • Expense reports for unapproved items are posting. • VanArsdel, Ltd. exceeded its credit limit but the sales order was processed. • Tailspin Toys purchases $70,000 in custom software development. You need to prevent prohibited expenses from posting. Which configurations should you use? To answer, select the appropriate options in the answer area NOTE: Each correct selection is worth one point.

A company plans to allocate revenue across occurrences by using recognition basis. Which recognition basis can you use?

A. Mid-month split

B. Revenue schedule

C. Actual start date

D. Monthly

Free Access Full MB-310 Practice Exam Free

Looking for additional practice? Click here to access a full set of MB-310 practice exam free questions and continue building your skills across all exam domains.

Our question sets are updated regularly to ensure they stay aligned with the latest exam objectives—so be sure to visit often!

Good luck with your MB-310 certification journey!