MB-310 Mock Test Free – 50 Realistic Questions to Prepare with Confidence.

Getting ready for your MB-310 certification exam? Start your preparation the smart way with our MB-310 Mock Test Free – a carefully crafted set of 50 realistic, exam-style questions to help you practice effectively and boost your confidence.

Using a mock test free for MB-310 exam is one of the best ways to:

- Familiarize yourself with the actual exam format and question style

- Identify areas where you need more review

- Strengthen your time management and test-taking strategy

Below, you will find 50 free questions from our MB-310 Mock Test Free resource. These questions are structured to reflect the real exam’s difficulty and content areas, helping you assess your readiness accurately.

HOTSPOT - A company is implementing Microsoft Dynamics 365 Finance. The company is implementing the Fixed asset module and requires the following configuration: • Set the threshold for fixed asset acquisitions at $10,000. • Fixed asset acquisitions must be allowed from purchasing. You need to configure the system. Which parameter should you use? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

You are configuring Dynamics 365 Finance. You need to implement posting definitions for all available transaction types. For which type of transactions can you implement posting definitions?

A. Accounts payable, Accounts receivable, Bank, Budget, Payroll, and Purchasing

B. Accounts payable, Bank, Budget, Fixed assets, and Payroll

C. Accounts payable, Accounts receivable, Fixed assets, Payroll, and Purchasing

D. Accounts payable, Accounts receivable, Budget, and Fixed assets

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution. After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A customer uses Dynamics 365 Finance. The controller notices incorrect postings to the ledger entered via journal. The system must enforce the following: ✑ Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional. ✑ Revenue accounts (4000-4999) require department and division and allow project and customer dimensions. ✑ Liability accounts (2000-2999) should not have any dimensions posted. ✑ Expense account (6999) requires department, division, project and customer dimensions with all transactions. You need to configure the account structure to meet the requirements. Solution: ✑ Configure one account structure. ✑ Configure an advanced rule for Liability accounts (2000-2999) not to display any dimensions when selected. ✑ Configure an advanced rule for Expense account (6999) to require customer. ✑ Configure the structure with all dimension fields containing quotations. Does the solution meet the goal?

A. Yes

B. No

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. You are managing credit and collections. You need to set up mandatory credit limits for all customer documents. Solution: Define a credit limit for each customer and select the Mandatory credit limit check box on the Customers form. Does the solution meet the goal?

A. Yes

B. No

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review. You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller s needs. Which functionality should you configure?

A. a Ledger daily journal workflow that uses the organizational hierarchy for journal posting, associated with the General ledger journal name

B. a saved query in the Voucher inquiries form for the controller to view all general journals posted to the ledger

C. a manual journal approval with the journal assigned to the user group that the employees are assigned to

D. the controller’s security rote so that he has approval privileges for General ledger journals

HOTSPOT - A company plans to implement expense management in Dynamics 365 Finance. The finance manager requires the following functionality: • Define rules that employees must follow to submit an expense report. • Share expense classifications between expense management and project accounting. • Approve expenses on behalf of another employee. You need to recommend configuration options. Which configuration options should you recommend? To answer, select the appropriate options in the answer area.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. You manage a Dynamics 365 Finance implementation. You must provide the budget versus actual reporting in near real time. You need to configure the ledger budgets and forecasts workspace to track expenses over budget and revenue under budget. Solution: Define a budget model. Set active forecasting process to the current year forecast. Does the solution meet the goal?

A. Yes

B. No

A company plans to allocate revenue across occurrences by using recognition basis. Which recognition basis can you use?

A. Actual start date

B. Mid-month split

C. First of month

D. Monthly by dates

HOTSPOT - A company charges customers for freight costs. These charges are not added to the items on the order. You need to configure the charge code for Accounts receivable. What should you configure? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

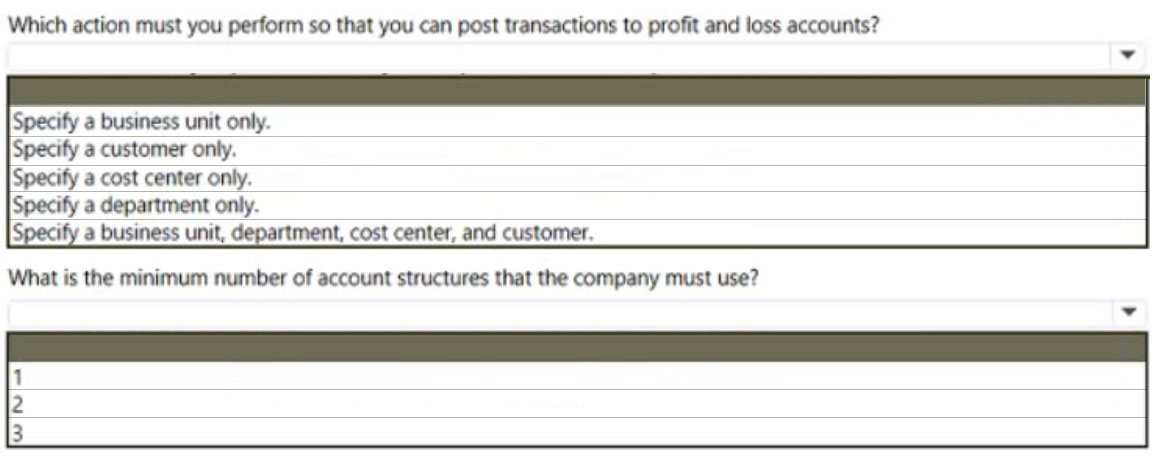

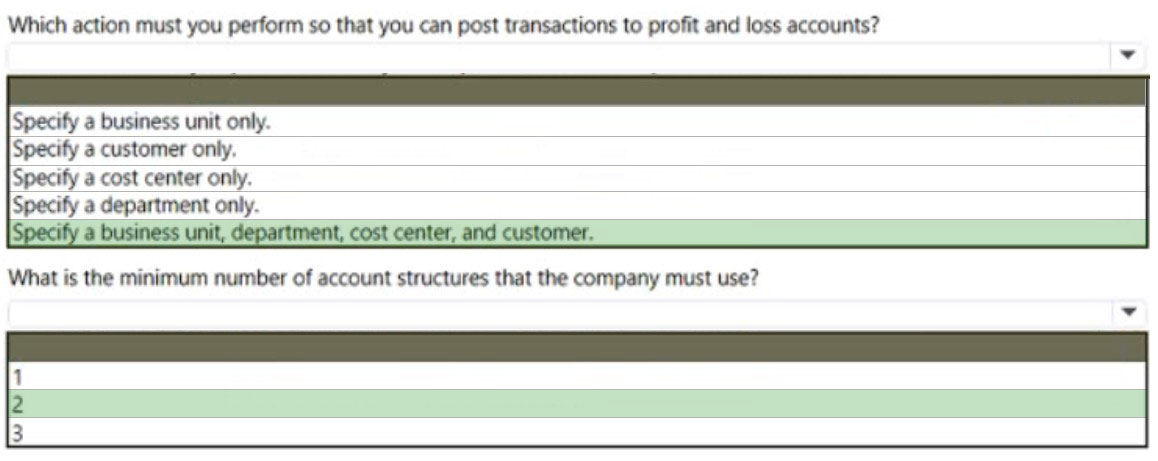

HOTSPOT - A company wants to track balance sheet accounts 10000..39999 by using different dimensions than their profit and loss accounts 40000..99999. The company wants to track the Customer financial dimension for profit and loss accounts. The company sets up the following structure:Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

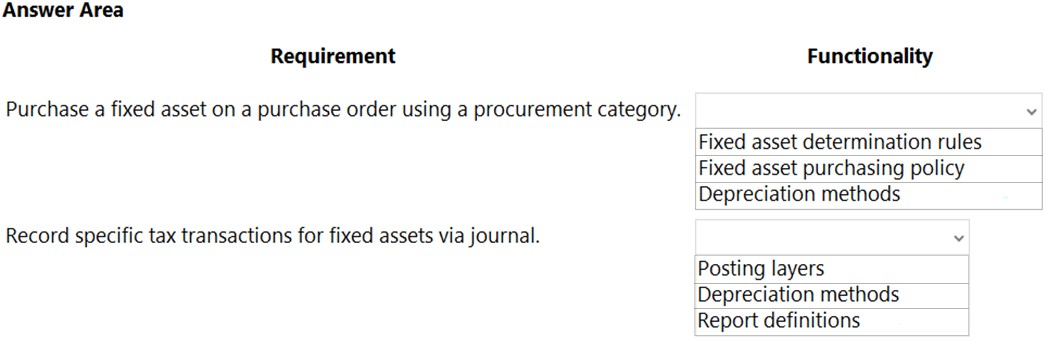

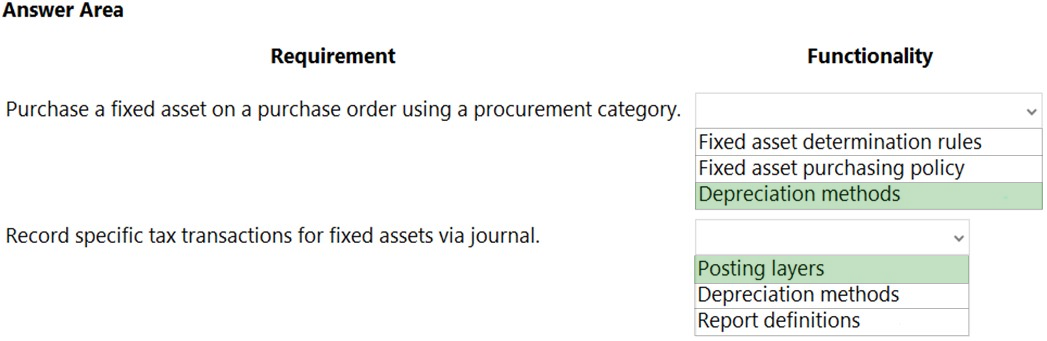

HOTSPOT - A company is implementing Dynamics 365 Finance. The company purchases fixed assets using a purchase order. The company must post tax-specific transactions related to the fixed assets so the transactions can be reported separately. You need to configure the system. What should you configure? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

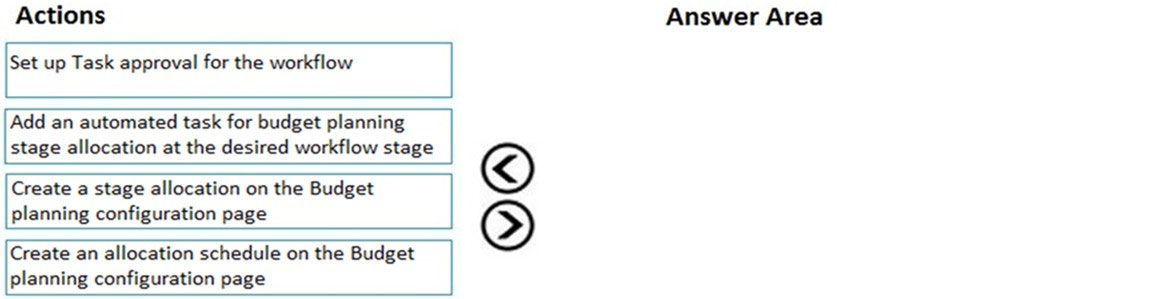

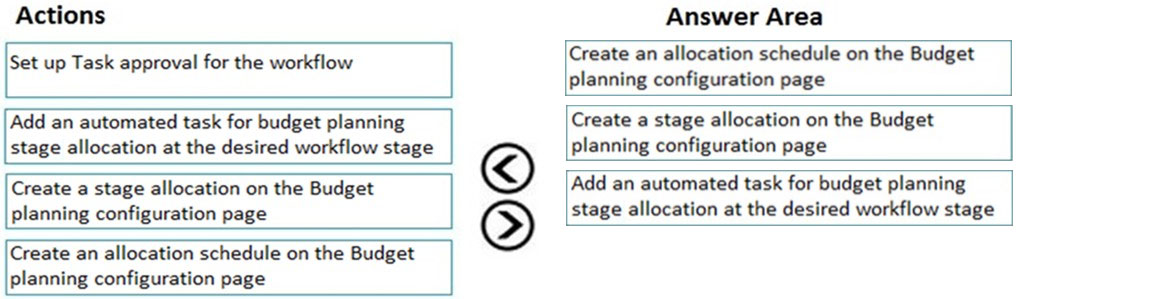

DRAG DROP - You are creating a budget for an organization. The organization requires that allocations be performed automatically as part of budget planning. You need to invoke allocations at a specific budget planning stage. Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

You are migrating data from a legacy system to Dynamics 365 Finance. The legacy customer master data does not include a customer grouping. Customers must be assigned to a group. You need to configure the posting profile. What should you set up?

A. an interest code for a group of customers

B. a revenue account for sales orders transactions for a group of customers

C. terms of payment for a group of customers

D. a payable account for specific customers

A company uses Dynamics 365 Finance to manage billing and expenses for projects. Team members complete expense reports and submit the expense reports to a project manager for approval. Each expense report must contain expense lines for one project only. Expense reports that are submitted without a project specified must be rejected. You need to configure an expense report approval workflow. Which three actions should you take? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Create an expenditure reviewers’ group in Expense management.

B. Create a user group for project managers and add all project managers to the group.

C. Create an expense report workflow.

D. Set up a condition to run an approval step only if the expense report has a project specified. Set the workflow assignment to Expenditure reviewers.

E. Set up an automatic action to reject expense report lines that do not have projects specified. Set the workflow assignment to Expenditure reviewers.

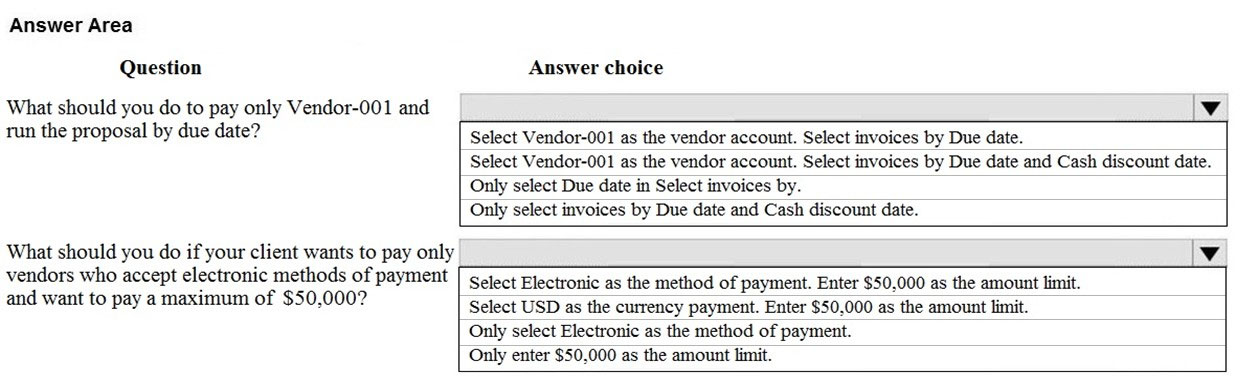

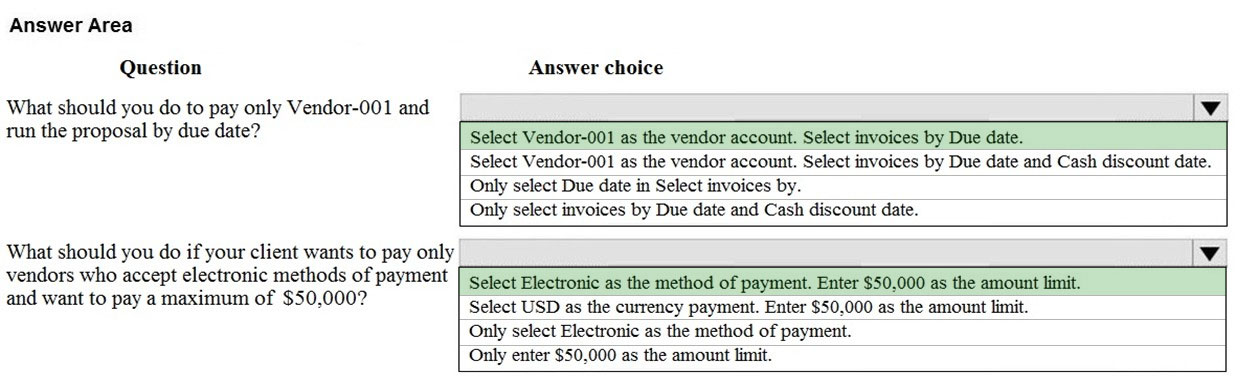

HOTSPOT - You are creating a payment proposal that shows invoices that are eligible to be paid. You display the Accounts payable Payment proposal screen from the Accounts payable payment journal.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are purchased totaling USD1,000. When the purchase invoice is prepared, USD10,000 is keyed in by mistake. Which configuration determines the result for this intercompany trade scenario?

A. Post invoices with discrepancies is set to require approval.

B. Match invoice totals is set to yes.

C. Three-way match policy is configured.

D. Two-way match policy is configured.

E. Post invoices with discrepancies is set to allow with warning.

You are implementing Dynamics 365 Finance. You need to enable electronic fund transfers (EFT) for vendors. Which three steps must you complete? Each correct answer presents pail of the solution. NOTE: Each correct selection is worth one point.

A. Enable the EFT format as a method of payment within Accounts payable.

B. Import a new Electronic reporting (ER) configuration into Lifecycle Services (LCS).

C. Import the X++ file format.

D. Import the payment model into the Electronic reporting (ER) repository.

E. Export Electronic reporting (ER) configuration from Lifecycle Services (LCS).

A company implements basic budgeting functionality in Dynamics 365 Finance. Budget managers must be notified of a budget register posting task after a finance director approves an entry. You need to configure the system. Which workflow element should you use?

A. Commitment approval

B. Update budget balances budget register

C. Budget planning stage allocation

D. Approve budget account entry

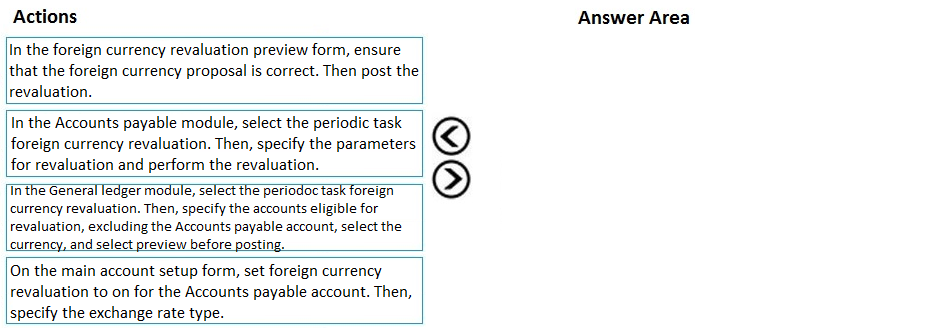

DRAG DROP - A client has Accounts payable invoices in their legal entity in three different currencies. It is month-end, and the client needs to run the foreign currency revaluation process to correctly understand their currency exposure. You need to set up Dynamics 365 Finance to perform foreign currency revaluation. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order. NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select. Select and Place:

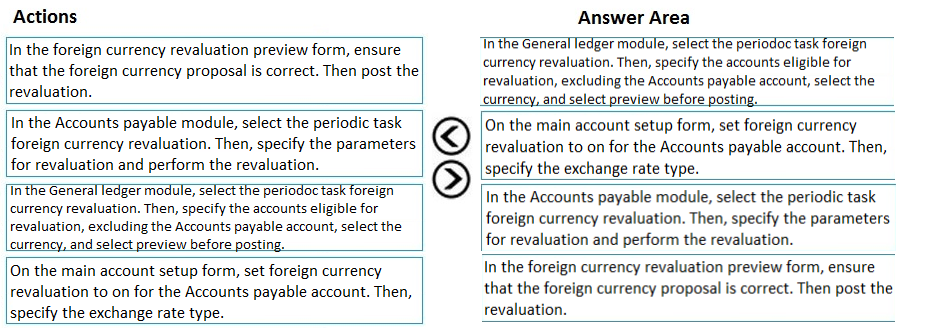

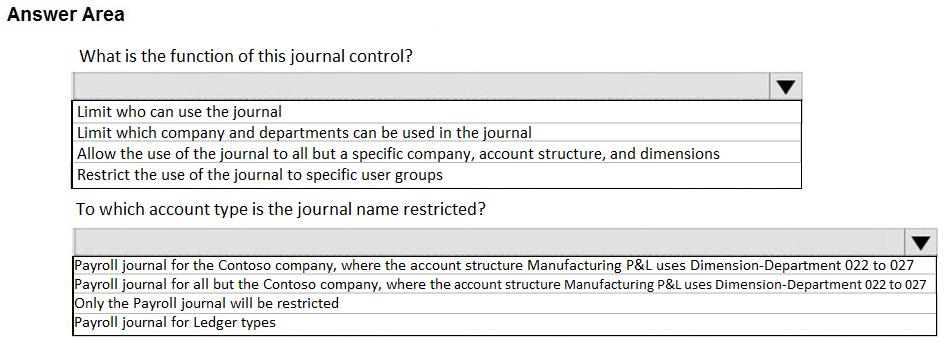

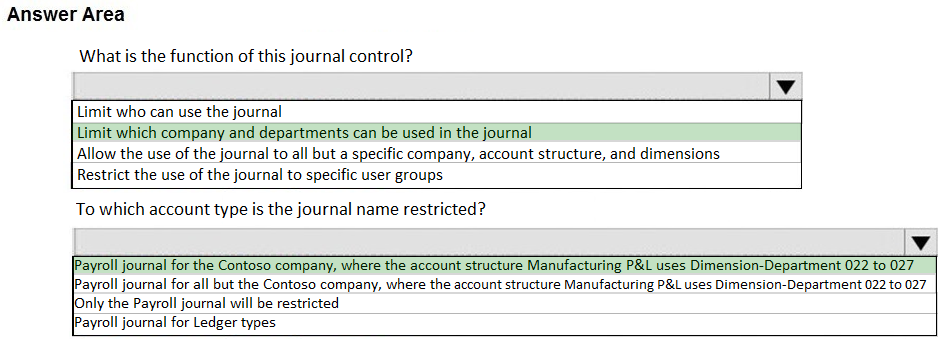

HOTSPOT - You must configure journal controls in Dynamics 365 Finance.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

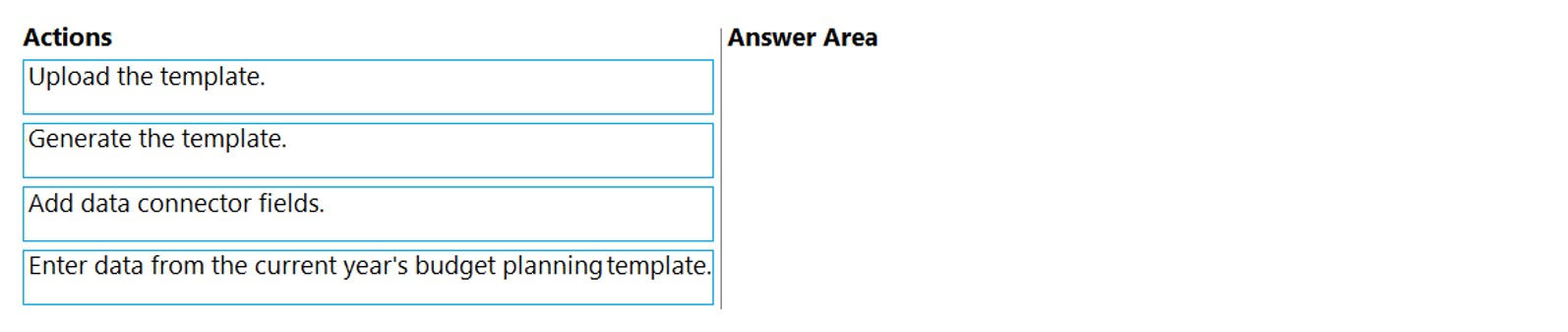

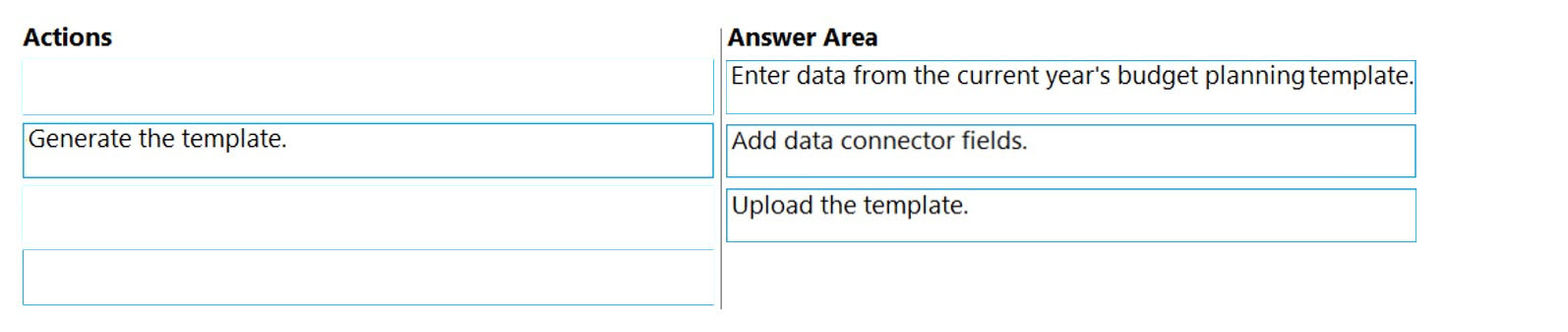

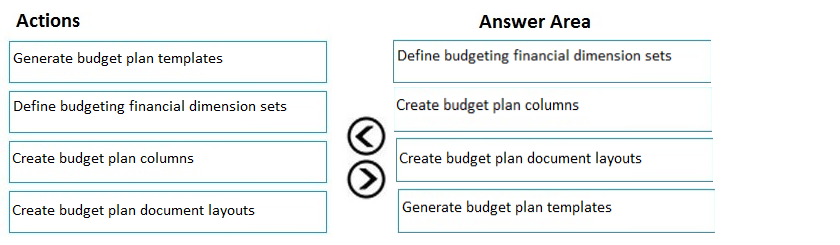

DRAG DROP - You are using Microsoft Excel to complete budget planning for the next fiscal year. Budget template data must be gathered in real time from Dynamics 365 Finance during the budget planning process. You need to create a budget planning template by using Microsoft Excel. Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

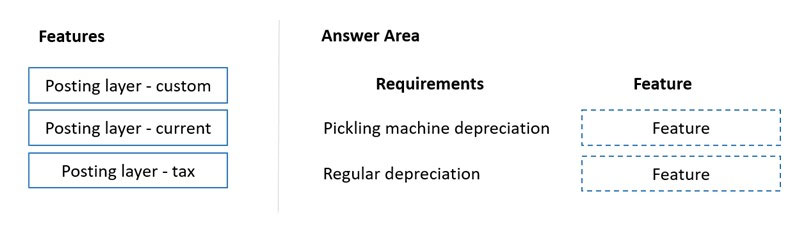

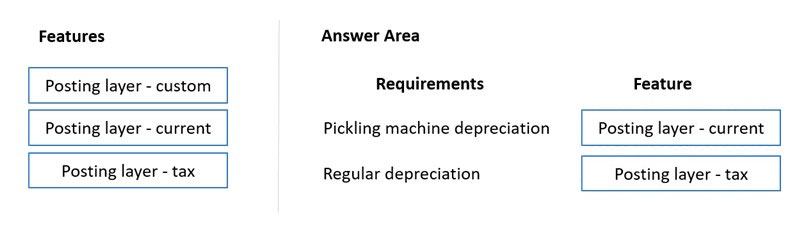

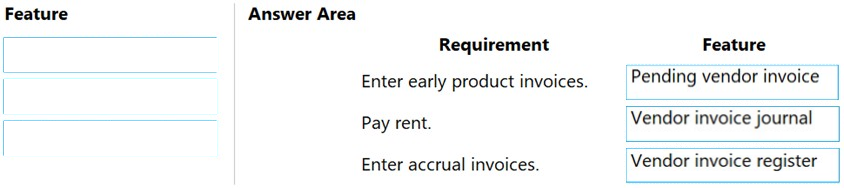

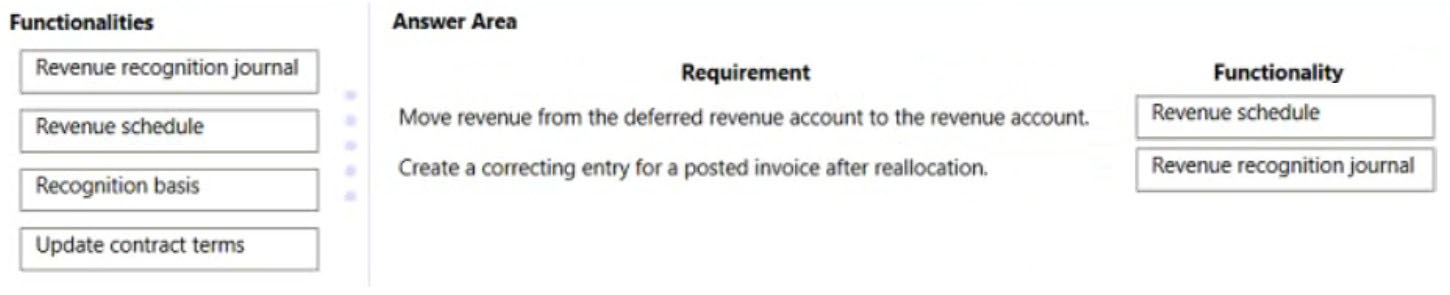

DRAG DROP - You need to select the functionality to meet the requirement. Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

DRAG DROP - A company uses Microsoft Dynamics 365 Finance. You receive a new purchase invoice. You must process the invoice as a fixed asset that complies with applicable tax regulations. Double entry is not permitted for asset acquisitions. You need to configure the asset and books. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

A company uses Microsoft Dynamics 365 Finance. You create revenue allocation schedules for items. You need to link a revenue allocation schedule to an item. Which two pages should you use? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Item group

B. Revenue allocation journal

C. Released item

D. Item posting profile

E. Charges group

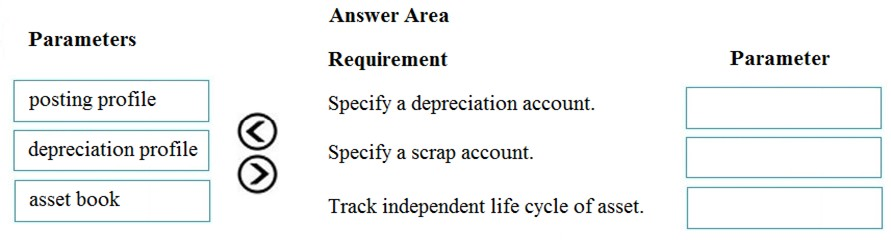

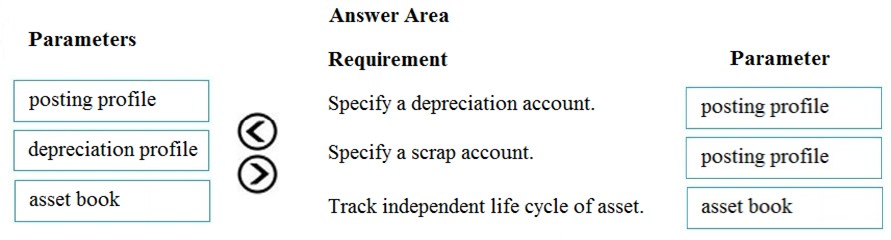

DRAG DROP - A client is implementing fixed assets in Dynamics 365 Finance. You need to specify which parameters should be configured to meet the business requirements. Which parameters meet the requirements? To answer, drag the appropriate parameters to the correct requirements. Each parameter may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

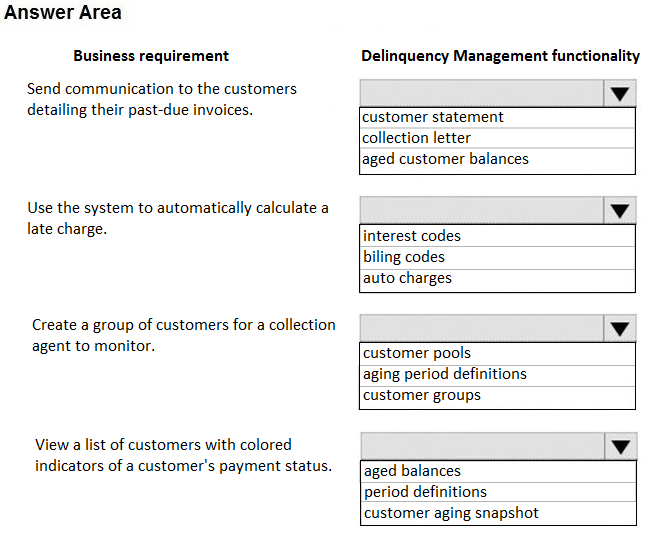

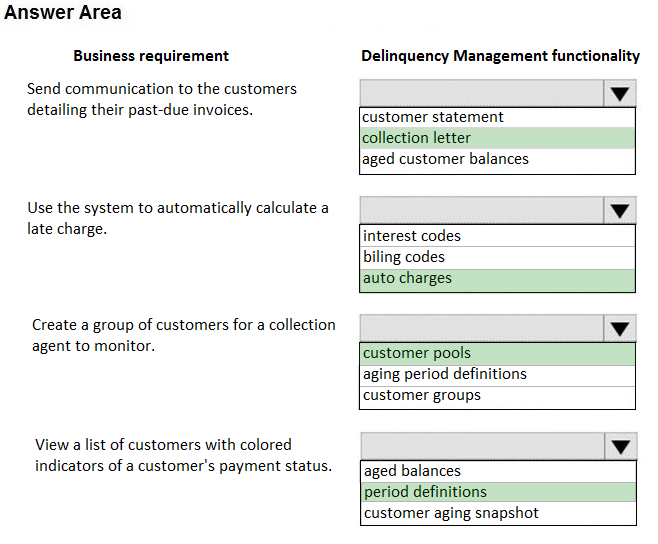

HOTSPOT - A company has delinquent customers. You need to configure Dynamics 365 Finance to meet the following requirements: ✑ Send communication to the customers detailing their past-due invoices. ✑ Use the system to automatically calculate a late charges. ✑ Create a group of customers for a collection agent to monitor. ✑ View a list of customers with colored indicators of a customer's payment status. You need to associate the correct system functionality to manage delinquent customers based on these business requirements. Which functionality should you use? To answer, select the appropriate configuration in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

You are configuring account structures and advanced rules in Dynamics 365 Finance. All balance sheet accounts require Business Unit and Department dimensions. The Shareholder distribution account requires an additional dimension for Principal. You need to set up the account structures. What are two possible ways to achieve the goal? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Create a new main account for each of the company’s principals. Then, create an account structure for all balance sheet accounts that includes the required dimension.

B. Create a new main account for Shareholder distribution. Add an advanced rule for the Principal dimension.

C. Create an account structure for all the balance sheet accounts. Set up an advanced rule for the Shareholder distribution account for the Principal dimension.

D. Create an account structure for balance sheet accounts without Shareholder distribution. Then, create a second account structure for Shareholder distribution that includes all required dimensions.

A company implements basic budgeting functionality in Dynamics 365 Finance. The company wants to allocate budget register entries for sales expense amounts to each period based on a predetermined percentage. You need to configure the allocation. Which functionality should you use?

A. Budget control

B. Budget transfer rule

C. Allocation term

D. Period allocation key

You need to configure the system to resolve User8's issue. What should you select?

A. the Standard sales tax checkbox

B. the Conditional sales tax checkbox

C. a main account in the settlement account field

D. a main account in the sales tax payable field

DRAG DROP - You need to configure the system to meet invoicing requirement. Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

DRAG DROP - A company uses Dynamics 365 Finance. You need to use the advanced bank reconciliation feature to reconcile bank transactions. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Users are posting project transactions and bank transactions incorrectly in the General journal. The client wants to prevent this from happening in the future. You need to configure Dynamics 365 Finance to limit the account type transactions to only ledger. What should you do?

A. Use journal control to specify which account types are valid for the General ledger journal.

B. Use advanced ledger entries to define the account types that can be used in the General ledger journal.

C. Configure the voucher series associated with this journal to allow only ledger account types.

D. Create a journal template that has ledger as the account type and offset account type.

A cable and internet company implements Dynamics 365 Finance. The primary line of business for the company is internet services. The company also sells routers and modems to customers for an additional one-time cost. You need to configure revenue recognition. What should you configure?

A. Create a revenue schedule for the internet service, router, and modem.

B. Configure the internet service as essential.

C. Configure the internet service, router, and modem as essential.

D. Create the router and modem sales to post to deferred revenue.

A company manufactures and installs air filtering units for industrial manufacturing plants. The air filtering units are manufactured to order. The company realized the value of the sales in the following manner: • 25 percent at the time of the sale • 50 percent when the unit is shipped • 25 percent when the unit is installed Additionally, a three-year warranty is sold with each unit. Revenue for the warranty is recognized equally in each year the warranty covers. You need to configure revenue recognition. What should you do?

A. Create one revenue schedule with milestones.

B. Create a new revenue schedule for each unit.

C. Create a reallocation posting for the warranty revenue.

D. Create the revenue schedule so that it uses the contract terms.

DRAG DROP - A company is implementing Microsoft Dynamics 365 Finance. The company has multiple vehicles. You depreciate all vehicles by using the straight-line service life depreciation method. The same ledger account is used to record the transaction when vehicle assets are acquired. You need to configure the vehicles as fixed assets in the system. Which feature should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

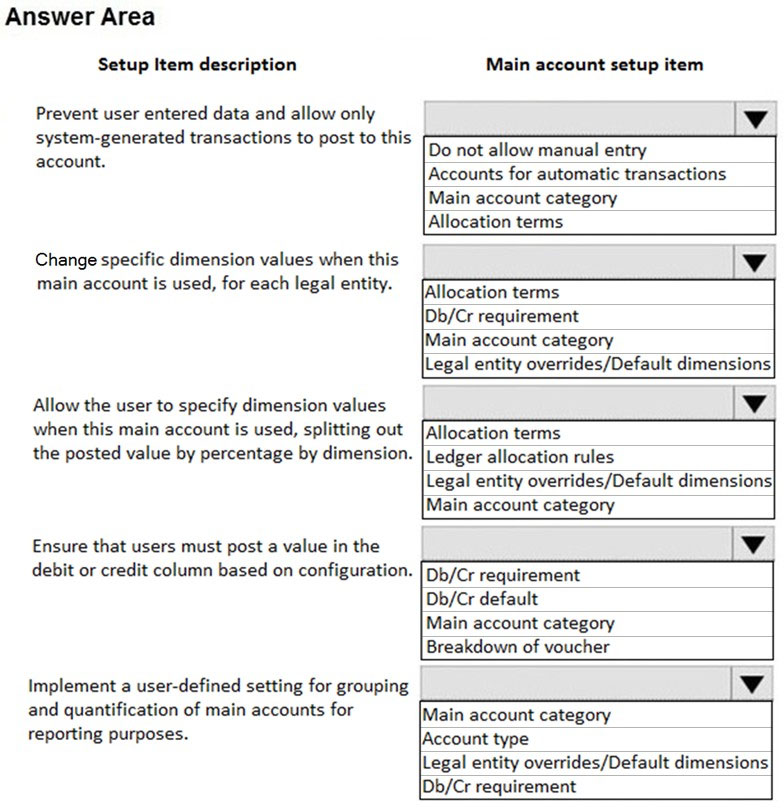

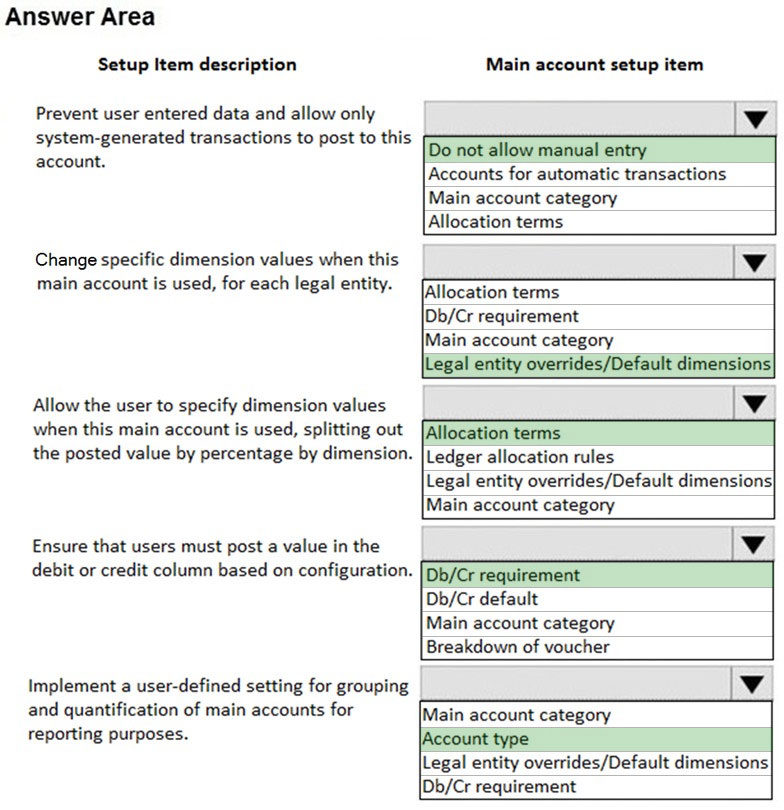

HOTSPOT - You are setting up main accounts in Dynamics 365 Finance. You need to configure the main accounts to meet the requirements. Which options should you use? To answer, select the appropriate configuration in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

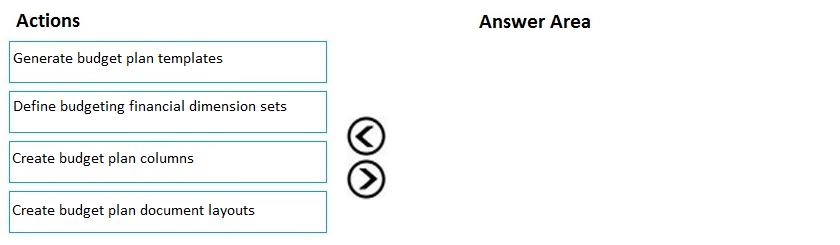

DRAG DROP - A company needs to create budget plan templates for its budgeting process. You need to create the budget plan templates. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

A customer uses bank reconciliation functionality in Dynamics 365 Finance. The customer finds a transaction in a closed fiscal period that must be corrected. You need to correct the transaction. How should you make this correction?

A. Use the Correction amount field.

B. Open the fiscal pend.

C. Create a new line for the transaction in the closed period.

D. Create a new line for the transaction in an open period.

A customer uses the sales tax functionality in Dynamics 365 Finance. The customer reports that when a sales order is created, sales tax does not calculate on the line. You need to determine why sales tax is not calculated. What are two possible reasons? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. The sales tax group is populated on the line, but the item sales tax group is missing.

B. The sales tax settlement account is not configured correctly.

C. The sales tax authority is not set up for the correct jurisdiction.

D. The sales tax code and item sales tax code are selected, but the sales tax group is not associated to both codes.

E. The sales tax group and item sales tax group are selected, but the sales tax code is not associated with both groups.

HOTSPOT - A company implements Dynamics 365 Finance. The company has six departments for budget planning purposes. The company is budget planning and requires the following scenarios: • A previous year budgeted scenario will be generated by the finance department. • The baseline scenario will be generated based on the previous year budget scenarios with some increase. • A baseline scenario will be sent to each department to review. • Department requested scenarios will be keyed in by a department manager based on their review of the baseline scenario. • Department requested scenarios will be aggregated back to the finance department, so finance can see the total budget requested. • Finance will approve the final budget in Department approved scenario. You need to configure allocation schedules to populate a baseline column for each department in the review process. How should you configure budget planning? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

A company uses Dynamics 365 Finance. The company has decided to implement basic budgeting to track budgeted versus actual amounts. You need to configure the system to track and identify budget transactions and set up controls on budget balance updates. What should you define?

A. Budget cycle time span

B. Budget threshold

C. Budget transfer rules

D. Budget plan

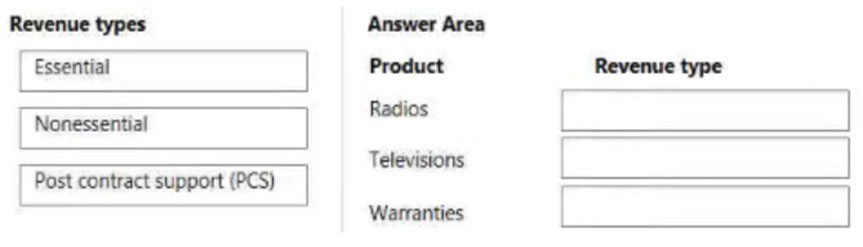

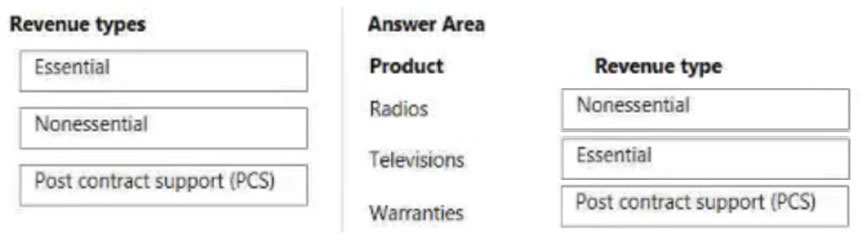

DRAG DROP - You are configuring Microsoft Dynamics 365 Finance. Your company sells televisions, radios, and warranties. Televisions are considered the primary revenue source. You enter a sales order and add the three products. A discount is applied on the order. Televisions must have a fixed price for revenue recognition. The revenue of warranties must be allocated to all televisions. Any remaining discount can be applied by using the radios. Released products must be configured so that applied discounts will have the requested impact on the revenue recognition. You need to configure the released products. Which revenue type should you use? To answer, drag the appropriate revenue type to the correct products. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

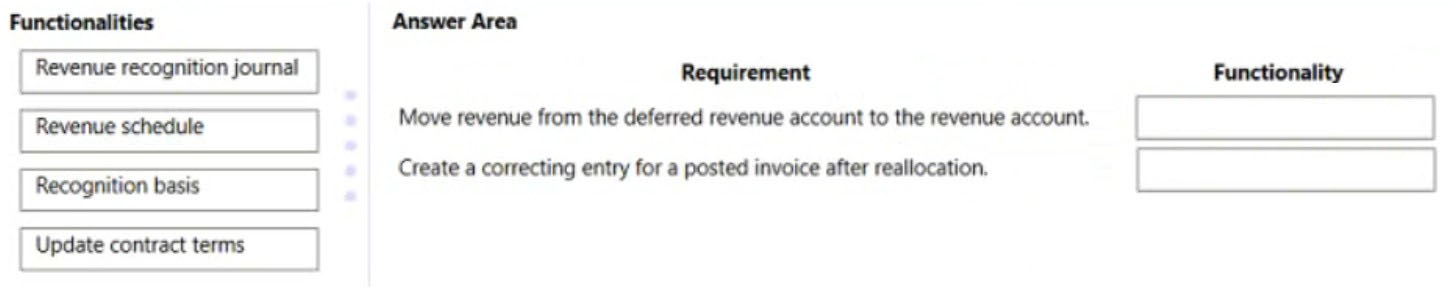

DRAG DROP - A company is implementing Dynamics 365 Finance. The company needs the ability to handle deferring revenue, reallocations, revenue schedules, and milestone-based recognition. You need to configure the functionality. What should you do? To answer, drag the appropriate functionality to the correct requirement. Each functionality may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

A client uses Dynamics 365 Finance for accounts receivable. You need to configure the method of payment to enforce the accounts receivable clerk to enter the wire number for the received electronic payment. Which item should you set up as mandatory?

A. Select bank transaction type

B. Select payment reference

C. Select Payment ID

D. Select Deposit slip

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which tasks can this vendor perform?

A. Activate or inactivate the association between a contact person and a vendor account.

B. Delete any contact person that they have created.

C. View and modify contact person information, such as the person’s title, email address, and telephone number.

D. View consignment inventory.

You need to troubleshoot the reporting issue for User7. Why are some transactions being excluded?

A. User7 is running the report in CompanyB.

B. User7 is running the report in CompanyA.

C. The report is correctly excluding CustomerY transactions.

D. The report is correctly excluding CustomerZ transactions.

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which task can this vendor perform?

A. View consignment inventory.

B. Add a new or existing contact person to the vendor accounts that they are a contact for.

C. Deny or allow a contact person’s access to documents on the vendor collaboration interface that are specific to the vendor account.

D. View and modify contact person information, such as the person’s title, email address, and telephone number.

A company provides employee life insurance to all full-time employees. Employee life insurance policies are paid twice a year to the insurance company. Transactions for current employees must be recognized in the general ledger twice a month with an employee's pay. Transactions for new employees must be recognized in the general ledger based upon the employee's first pay date. You need to configure accrual schemes for the new fiscal year. Which two configurations should you use? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. For new employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

B. For current employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the employee’s first pay date.

C. For new employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the employee’s first pay date.

D. For current employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

You manage fixed assets using Microsoft Dynamics 365 Finance. You need to define capitalization thresholds. Which page should you use?

A. Main account

B. Released item

C. Fixed asset posting profile

D. Fixed asset group

Case study - This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided. To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study. At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section. To start the case study - To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question. Background - First Up Consultants is a global engineering and consulting organization based in Atlanta. The organization assists customers with various implementation projects. The organization provides both consulting services and custom software development. First Up Consultants was recently acquired by a Canadian engineering firm that uses Dynamics 365 Finance. The firm requires First Up Consultants to transition to the solution by 2022. First Up Consultants employs consultants that travel globally, which requires extensive expense management capabilities. First Up Consultants offers software as a service (SaaS) products to customers by using monthly and quarterly subscriptions. Current environment. Travel and expense The company is currently in Phase 2 of their Dynamics 365 Finance implementation. • Consultants submit all travel receipts by using inter-office mail to the team admin for processing, but First Up Consultants wants to modernize this experience. • Expense reports are manually approved and signed by the employee’s manager. Current environment. Finance - • First Up Consultants operates on a 4-5-4 calendar. • Accounting for revenue has been difficult with the SaaS offerings. This has led to implementing Dynamics 365 Finance Revenue recognition. • Revenue recognition has been live for 3 months. • Adatum Corporation pays quarterly for use of the First Up Consultants web design application, starting from the day of use. • Fourth Coffee pays monthly for use of the First Up Consultants photograph editing application with a contract starting August 1 and payment starting September 1. • Adventure Works Cycles pays per use of the First Up Consultant video platform. • A blocking rule is set up to prevent a sales order from processing if a customer exceeds a credit limit. • Customer credit is set up at the account level for VanArsdel, Ltd. • Tailspin Toys is owned by Wingtip Toys. The companies have a credit limit of $60.000 and $100,000, respectively. Current environment. Revenue allocation The company reports the following revenue allocation percentages:Current environment. Tax - VAT tax recovery is required for eligible international business trip expenses. Bank reconciliation is manual and performed by using monthly mailed account statements. The company collects sales taxes from the following states:

Requirements - Travel and expense - • First Up Consultants requires that employees start using corporate cards for all travel expenses. • All expenses over $50 require a receipt. • Beer cannot be expensed. • Employees may use the corporate card for personal expenses during work travel, but expenses must be categorized correctly. • Client entertainment expenses totaling more than $250 must be audited. • Employees require a mobile expense experience. • Expense report entries must be validated when a transaction line is entered. • Employees require the ability to capture receipts by using a mobile device. • First Up Consultants requires the ability to reimburse employees in their paychecks for expenses incurred on personal cards. Financials - • A virtual thirteenth month is required for year-end transactions. • Each day, a validation file must go to First Up Consultants bank detailing all vendor checks paid. • Except fees, all matched transactions must clear automatically during bank reconciliation. • The accounts payable team must verify expense reports prior to posting. • Only payables are allowed to be posted to a prior period up to seven days into the new period. Issues - • User1 installed the Expense Management Service add-in and implemented the auto-match and create expense from receipt features, but the receipt images do not match the corporate card transactions. • Employee1 submits an expense report for a business trip to Europe, but the report is not visible on the expense tax recovery page. • Employees provided feedback that the system lets them know of an expense report policy violation only after the entire expense report is submitted. • Members of the finance department observe sales orders that posted into a closed period. • The finance team observed that for sales order invoice 1234, the price incorrectly posts to a revenue account when it should be deferring. • Employee2 purchased supplies for a holiday party and needs to be reimbursed. • A customer orders software licenses for the offices in Tennessee and Alabama. • Expense reports for unapproved items are posting. • VanArsdel, Ltd. exceeded its credit limit but the sales order was processed. • Tailspin Toys purchases $70,000 in custom software development. You need to address the posting of sales orders to a closed period. What should you do?

A. Permanently close the period for all modules.

B. Use a ledger calendar to update period status.

C. Permanently close the fiscal year.

D. Use a ledger calendar to update module access.

E. Divide the period.

Access Full MB-310 Mock Test Free

Want a full-length mock test experience? Click here to unlock the complete MB-310 Mock Test Free set and get access to hundreds of additional practice questions covering all key topics.

We regularly update our question sets to stay aligned with the latest exam objectives—so check back often for fresh content!

Start practicing with our MB-310 mock test free today—and take a major step toward exam success!