MB-310 Practice Questions Free – 50 Exam-Style Questions to Sharpen Your Skills

Are you preparing for the MB-310 certification exam? Kickstart your success with our MB-310 Practice Questions Free – a carefully selected set of 50 real exam-style questions to help you test your knowledge and identify areas for improvement.

Practicing with MB-310 practice questions free gives you a powerful edge by allowing you to:

- Understand the exam structure and question formats

- Discover your strong and weak areas

- Build the confidence you need for test day success

Below, you will find 50 free MB-310 practice questions designed to match the real exam in both difficulty and topic coverage. They’re ideal for self-assessment or final review. You can click on each Question to explore the details.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A company is preparing to complete yearly budgets. The company plans to use the Budget module in Dynamics 365 Finance for budget management. You need to create the new budgets. Solution: Combine budgets from multiple legal entities to a master budget. Does the solution meet the goal?

A. Yes

B. No

QUESTION NO: 86 - You are setting up the Accounts payable module and vendor invoice policies for an organization. You need to set up vendor invoice policies that run when vendor invoices are posted in the system. In which two ways can you set up the policies? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Set up invoice matching validation for vendor invoice policy.

B. Configure the vendor invoice workflow to run the policies.

C. Run the policies when you post a vendor invoice by using the Vendor invoice page and when you open the Vendor invoice policy violations page.

D. Apply the policies to invoices that were created in the invoice register or invoice journal.

You need to configure the system to resolve User8's issue. What should you select?

A. the Standard sales tax checkbox

B. the Conditional sales tax checkbox

C. a main account in the settlement account field

D. a main account in the sales tax payable field

An organization plans to set up intercompany accounting between legal entities within the organization. Automatic transactions between legal entities must meet the following requirements: ✑ Provide systemwide integration and streamlining to save time. ✑ Minimize errors and create an audit trail with full visibility into business activities and transaction histories within the legal entities. You need to set up intercompany accounting and create pairs of legal entities that can transact with each other, clearly defining the originating company and the destination company. Which three actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Select intercompany journal names.

B. Configure intercompany accounting in both the originating entity and destination entity.

C. Create intercompany main accounts to use for the due to and due from accounting entries.

D. Define intercompany accounting setup by creating legal entity pairs defining originating and destination companies.

E. Configure intercompany accounting in the destination entity only.

You are configuring the Fixed assets module for a Dynamics 365 Finance environment. You need to create a fixed asset. Which two settings are required? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. the property type

B. the group

C. the number sequence

D. the type

E. the name

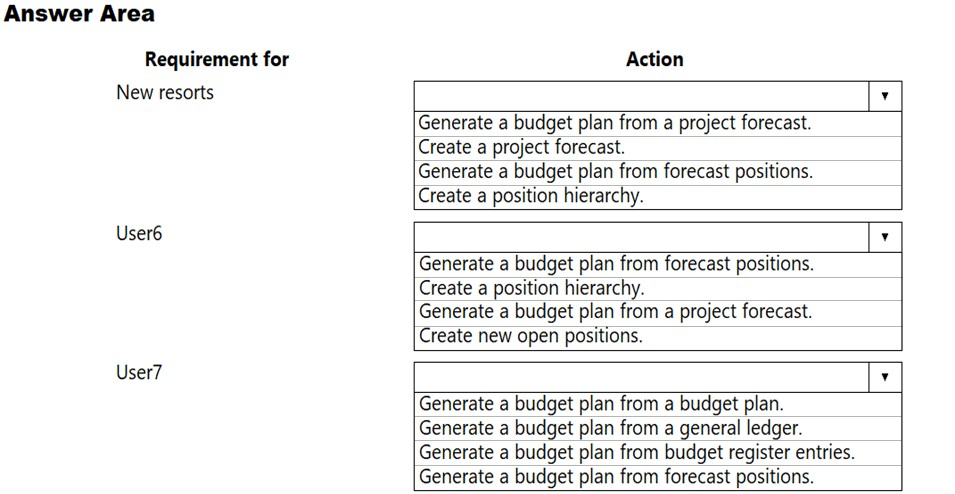

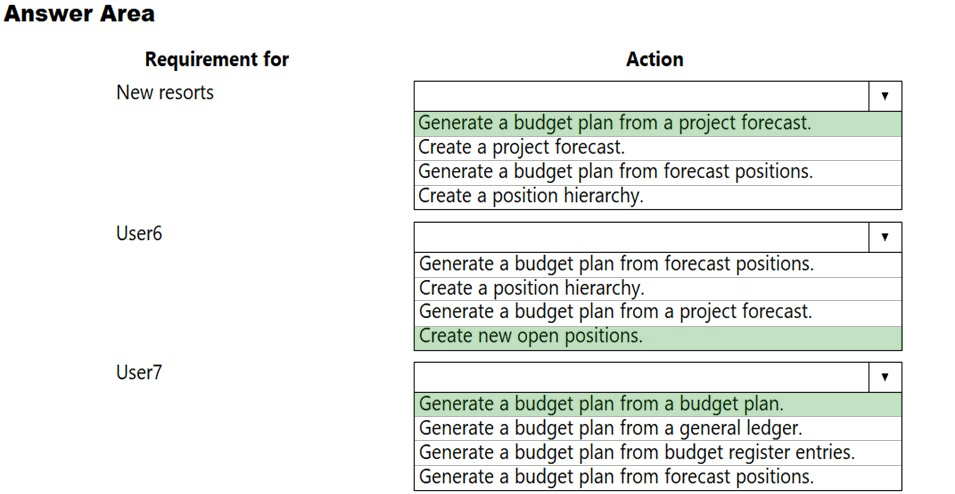

HOTSPOT - You need to configure the system to meet the budget preparation requirements. What should you do? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

You are the accounts receivable manager of an organization. The organization recently sold machinery to a customer. You need to register a transaction for the sale of the machinery by using a free text invoice for fixed assets. Which transaction type should you use?

A. Acquisition

B. Value adjustments

C. Depreciation

D. Disposal

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which tasks can this vendor perform?

A. Activate or inactivate the association between a contact person and a vendor account.

B. Delete any contact person that they have created.

C. View and modify contact person information, such as the person’s title, email address, and telephone number.

D. View consignment inventory.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions. The client has the following requirements: ✑ Only expense accounts require dimensions posted with the transactions. ✑ Users must not have the option to select dimensions for a balance sheet account. You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry. Solution: Configure default financial dimensions on expense accounts only. Does the solution meet the goal?

A. Yes

B. No

You need to configure the system to meet the fiscal year requirements. What should you do?

A. Add an additional fiscal year.

B. Divide the twelfth period.

C. Add an additional period to ledger calendars.

D. Create a closing period.

E. Create a new fiscal calendar.

You need to prevent the issue from reoccurring for User5. What should you do?

A. Use the audit list search query type.

B. Set up the aggregate query type for entertainment expenses.

C. Set up the sampling query type for entertainment expenses.

D. Add more keywords to the audit policy.

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which task can this vendor perform?

A. View consignment inventory.

B. Add a new or existing contact person to the vendor accounts that they are a contact for.

C. Deny or allow a contact person’s access to documents on the vendor collaboration interface that are specific to the vendor account.

D. View and modify contact person information, such as the person’s title, email address, and telephone number.

A company has implemented Dynamics 365 Finance. The company has three different banks where they hold funds. Each bank holds three separate accounts, totaling nine accounts for the company. The system must use default the bank information when a new account is created. All bank balances for a single bank account must be updated simultaneously. You need to configure the system. Which two entities should you use? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. bank account

B. bank reasons

C. bank reconciliation

D. bank group

You use Dynamics 365 Finance for daily bank reconciliation. You must use the BAI2 bank statement format. You need to configure the import bank statement format for the bank reconciliation process. What should you do?

A. Import the bank statement as a template for the bank statement format.

B. Set up a batch job to import the bank statement.

C. Set up an import project for the bank statement in a Data management workspace using files provided by Microsoft.

D. Set up a journal name to import a bank statement transaction.

You are a finance consultant. Your client needs you to configure cash flow forecasting. The client wants specific percentages of main accounts to contribute to different cash flow forecasts for other main accounts. You need to configure Dynamics 365 for Finance to meet the needs of the client. What should you do?

A. On the Cash flow forecasting setup form, configure the primary main account to assign a percentage to the dependent account.

B. Configure the parent/child relationship for the main account and subaccounts by using appropriate percentages.

C. Configure the cash flow forecasting setup for Accounts Payable before you configure vendor posting profiles.

D. On the Cash flow forecasting setup form, use the Dependent Accounts setup to specify which account and percentage is associated to the main account.

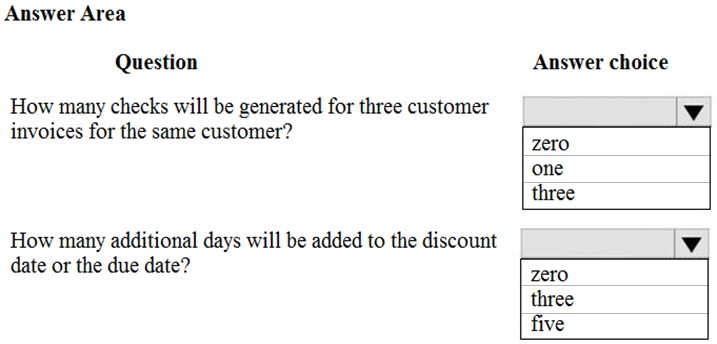

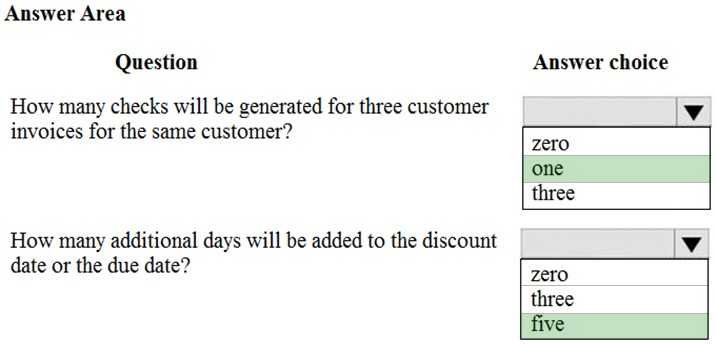

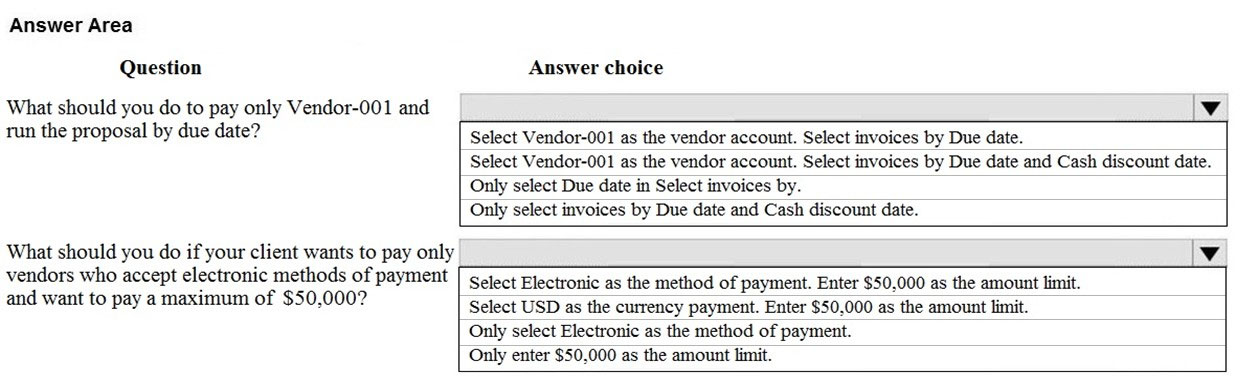

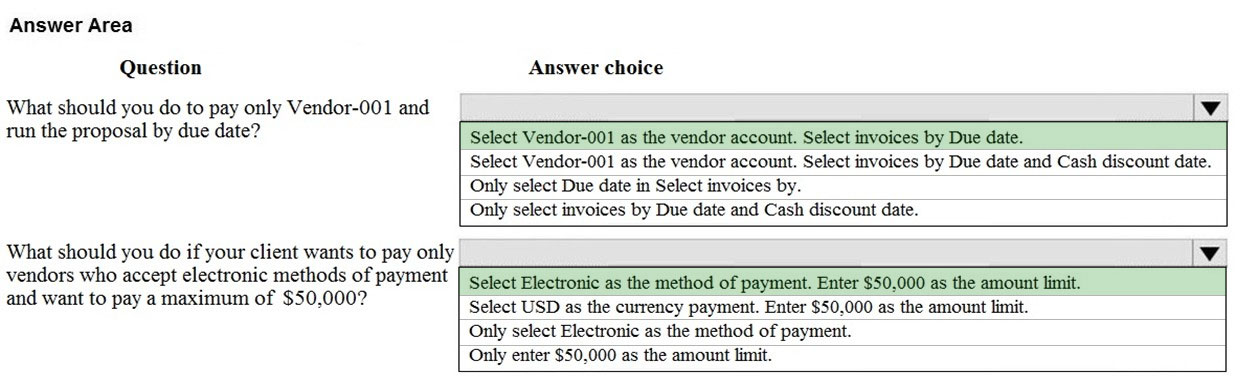

HOTSPOT -You are asked to configure the method of payments for vendors. You are viewing an Accounts payable method of payment. Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

You manage fixed assets using Microsoft Dynamics 365 Finance. You need to define capitalization thresholds. Which page should you use?

A. Main account

B. Released item

C. Fixed asset posting profile

D. Fixed asset group

DRAG DROP - A company uses Dynamics 365 Finance for expense management. The company has multiple legal entities and multiple departments. Each department may have a different expense policy that may conflict with the legal entity expense policy. You need to configure prioritization of department expense policy over legal entity expense policy. Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

A client uses Dynamics 365 Finance for accounts receivable. You need to ensure that accounts receivable clerks add the wire number for electronic payments. Which item should you set up as mandatory in the method of payment?

A. bank transaction type

B. payment ID

C. payment reference

D. deposit slip

An organization plans to use defined journal names for each purpose. They want to ensure that journal processing is easier and more secure. The organization has the following requirements: ✑ Set up restrictions on the account type and segment values. ✑ Capture data accurately for offset accounts, currency, and financial dimensions. ✑ Maintain internal control and establish materiality limits. You need to set up journal name elements to meet these requirements. Which three journal elements should you configure? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. workflow approval

B. account type

C. journal type

D. default values

E. journal control

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review. You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller s needs. Which functionality should you configure?

A. the controller’s security role so that he has approval privileges for General ledger journals

B. an Advanced ledger entry workflow that uses the organizational hierarchy for journal posting, associated with the Advanced ledger journal name

C. a Ledger daily journal workflow that uses the organizational hierarchy for journal posting, associated with the General ledger journal name

D. a manual journal approval with the journal assigned to the user group that the employees are assigned to

A company uses Microsoft Dynamics 365 Finance. You need to reclassify a fixed asset. Which three actions does the system perform when an asset is reclassified? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. The system will generate reclassification journals.

B. The new books of the new fixed asset contain the date of the reclassification in the Acquisition date field.

C. All books for the existing fixed asset are created for the new fixed asset.

D. The existing fixed asset transactions for the original fixed asset are canceled and regenerated for the new fixed asset.

E. The new fixed asset only cancels out possible depreciations because the reclassification date is filled in in the Acquisition date field.

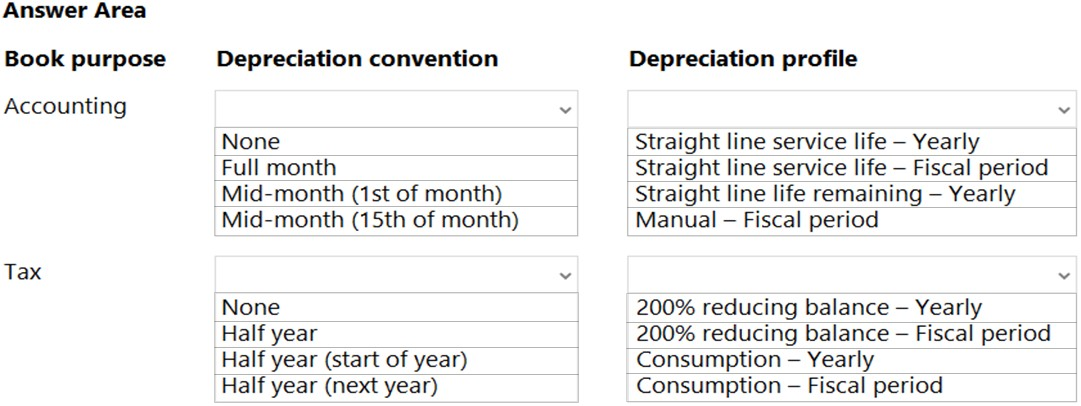

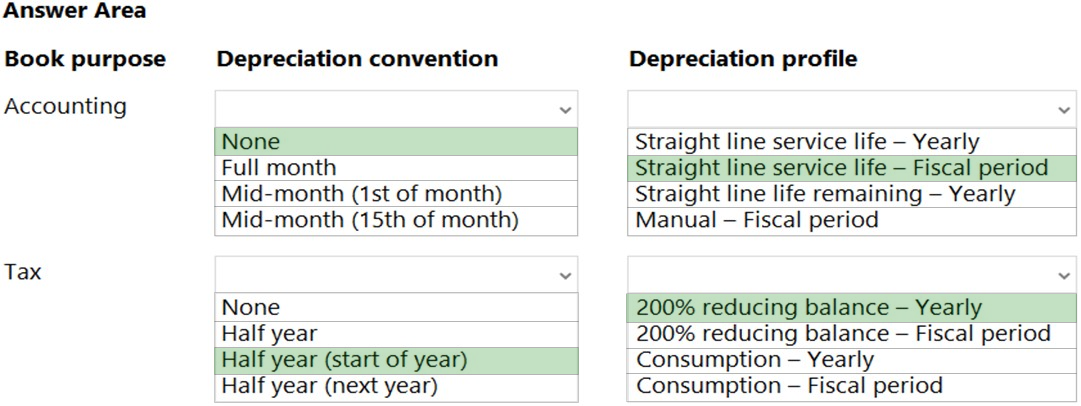

HOTSPOT - A company uses Dynamics 365 Finance to manage fixed assets. The company's fiscal year is set as the calendar year. The company requires two books for each fixed asset. The company has the following requirements for the books:You need to configure a fixed asset group book setup to meet the requirements. Which depreciation conventions and depreciation profiles should you use? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point. Hot Area:

HOTSPOT - A company uses Dynamics 365 Finance. The company has prepaid insurance expenses at the beginning of the calendar year that cover the entire year. The company must expense the prepaid insurance automatically and equally during a month-end process. You need to configure the accrual scheme. How should you configure the accrual scheme? To answer, select the appropriate options in the answer area. NOTE: Each correct answer is worth one point.

DRAG DROP - A company uses the basic budgeting functionality in Dynamics 365 Finance. You are creating the budget in the system for the upcoming fiscal year. The company uses budget workflow approvals to process budget entries. The company plans to split a business unit named IT and Infrastructure into two business units: Business Applications and IT Infrastructure. You need to create the budget for the two business units based on 1.5 times the original business unit actuals from the past year. Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365 Finance. The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Dynamics 365 Finance instead. You need to configure the system and correctly perform eliminations. Solution: Select Consolidate with import. Does the solution meet the goal?

A. Yes

B. No

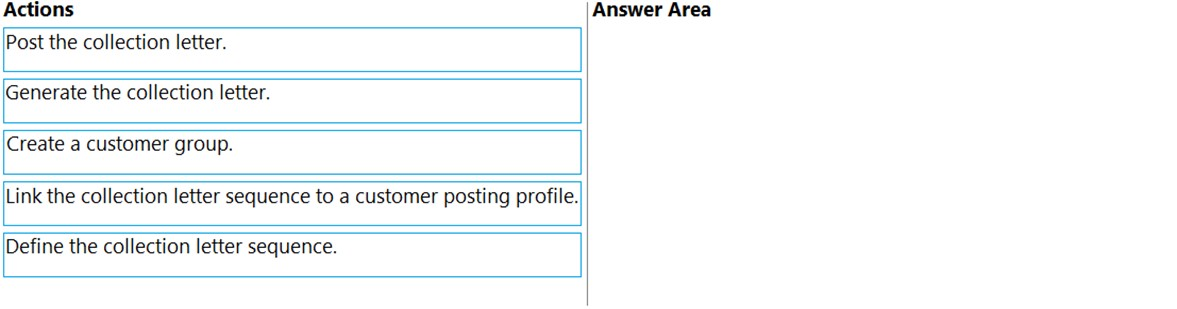

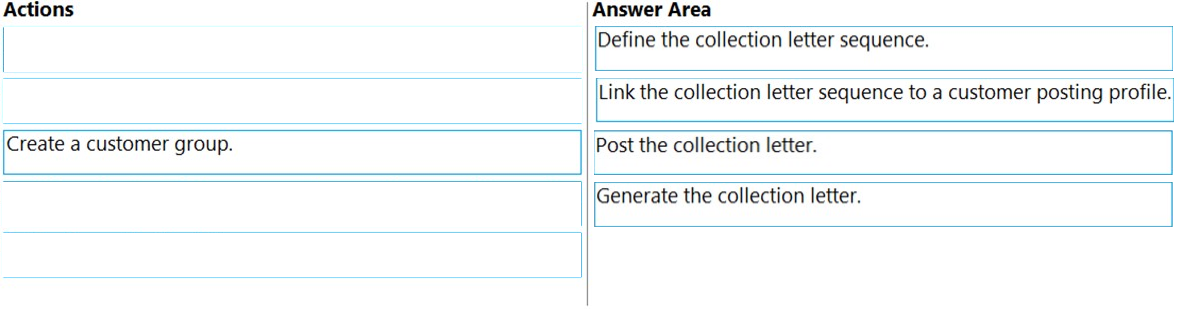

DRAG DROP - You manage customer credit and collections in a Dynamics 365 Finance implementation. At the beginning of each month, you must send collection letters to customers whose payments are overdue. You need to configure the collection letter functionality. Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

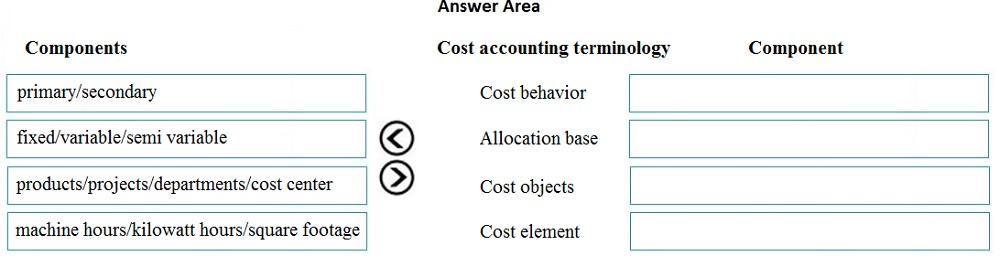

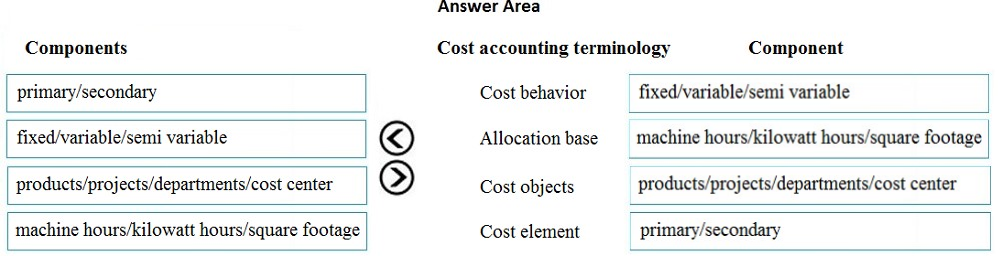

DRAG DROP - You are a controller in an organization. You are identifying cost drivers to see how changes in business activities affect the bottom line of your organization. You need to assess cost object performance to analyze actual versus budgeted cost and how resources are consumed. You need to demonstrate your understanding of cost accounting terminology. Which component maps to the cost accounting terminology? To answer, drag the appropriate component to the correct cost accounting terminology. Each source may be used once. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

A company implements basic budgeting functionality in Dynamics 365 Finance in multiple departments that belong to the same legal entity. Managers must be able to identify and track budgets by department. You need to configure the system. What should you configure?

A. Budget model with sub-models

B. Budget transfer rules

C. Budget codes and budget types

D. Budget entries workflows

HOTSPOT - Case study - This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided. To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study. At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section. To start the case study - To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question. Background - First Up Consultants is a global engineering and consulting organization based in Atlanta. The organization assists customers with various implementation projects. The organization provides both consulting services and custom software development. First Up Consultants was recently acquired by a Canadian engineering firm that uses Dynamics 365 Finance. The firm requires First Up Consultants to transition to the solution by 2022. First Up Consultants employs consultants that travel globally, which requires extensive expense management capabilities. First Up Consultants offers software as a service (SaaS) products to customers by using monthly and quarterly subscriptions. Current environment. Travel and expense The company is currently in Phase 2 of their Dynamics 365 Finance implementation. • Consultants submit all travel receipts by using inter-office mail to the team admin for processing, but First Up Consultants wants to modernize this experience. • Expense reports are manually approved and signed by the employee’s manager. Current environment. Finance - • First Up Consultants operates on a 4-5-4 calendar. • Accounting for revenue has been difficult with the SaaS offerings. This has led to implementing Dynamics 365 Finance Revenue recognition. • Revenue recognition has been live for 3 months. • Adatum Corporation pays quarterly for use of the First Up Consultants web design application, starting from the day of use. • Fourth Coffee pays monthly for use of the First Up Consultants photograph editing application with a contract starting August 1 and payment starting September 1. • Adventure Works Cycles pays per use of the First Up Consultant video platform. • A blocking rule is set up to prevent a sales order from processing if a customer exceeds a credit limit. • Customer credit is set up at the account level for VanArsdel, Ltd. • Tailspin Toys is owned by Wingtip Toys. The companies have a credit limit of $60.000 and $100,000, respectively. Current environment. Revenue allocation The company reports the following revenue allocation percentages:Current environment. Tax - VAT tax recovery is required for eligible international business trip expenses. Bank reconciliation is manual and performed by using monthly mailed account statements. The company collects sales taxes from the following states:

Requirements - Travel and expense - • First Up Consultants requires that employees start using corporate cards for all travel expenses. • All expenses over $50 require a receipt. • Beer cannot be expensed. • Employees may use the corporate card for personal expenses during work travel, but expenses must be categorized correctly. • Client entertainment expenses totaling more than $250 must be audited. • Employees require a mobile expense experience. • Expense report entries must be validated when a transaction line is entered. • Employees require the ability to capture receipts by using a mobile device. • First Up Consultants requires the ability to reimburse employees in their paychecks for expenses incurred on personal cards. Financials - • A virtual thirteenth month is required for year-end transactions. • Each day, a validation file must go to First Up Consultants bank detailing all vendor checks paid. • Except fees, all matched transactions must clear automatically during bank reconciliation. • The accounts payable team must verify expense reports prior to posting. • Only payables are allowed to be posted to a prior period up to seven days into the new period. Issues - • User1 installed the Expense Management Service add-in and implemented the auto-match and create expense from receipt features, but the receipt images do not match the corporate card transactions. • Employee1 submits an expense report for a business trip to Europe, but the report is not visible on the expense tax recovery page. • Employees provided feedback that the system lets them know of an expense report policy violation only after the entire expense report is submitted. • Members of the finance department observe sales orders that posted into a closed period. • The finance team observed that for sales order invoice 1234, the price incorrectly posts to a revenue account when it should be deferring. • Employee2 purchased supplies for a holiday party and needs to be reimbursed. • A customer orders software licenses for the offices in Tennessee and Alabama. • Expense reports for unapproved items are posting. • VanArsdel, Ltd. exceeded its credit limit but the sales order was processed. • Tailspin Toys purchases $70,000 in custom software development. You need to prevent prohibited expenses from posting. Which configurations should you use? To answer, select the appropriate options in the answer area NOTE: Each correct selection is worth one point.

You are implementing Dynamics 365 Finance. You configure an invoice validation policy to use three-way matching and use a three percent tolerance for invoice totals. A user enters a vendor invoice journal. The invoice validation policy is not applied. You need to troubleshoot the policy. What is the issue with the policy?

A. Validation is only performed on vendor invoice entries.

B. The tolerance percentage is too high.

C. Validation is only performed on invoice register entries.

D. Validation is configured to check for price and quantity.

You need to configure the financial reporting fiscal calendar for CustomerX. What should you do?

A. Use the ledger calendar to set up the 4-5-4 calendar.

B. Configure the fiscal calendar to include a 13 th closing period.

C. Configure the ledger calendar to include a 13 th closing period.

D. Use the closing period adjustments form.

Manual entry of currency exchange rates must be discontinued. Currency exchange rates must use the current rate values provided by the European Central Bank. The exchange rate entries and updates must be automated. You need to configure the system. Which two options should you use? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Configure the exchange rate provider

B. Run currency revaluation

C. Create the currencies

D. Configure dual currency

E. Run the import currency exchange rate process

DRAG DROP - A company uses basic budgeting functionality in Dynamics 365 Finance. The company wants to add fixed asset depreciation expenses to its budget register entry. The depreciation expense must be automatically calculated. You need to create budget register entries for fixed asset depreciation expense. Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

A company implements basic budgeting functionality in Dynamics 365 Finance. Budget managers must be notified of a budget register posting task after a finance director approves an entry. You need to configure the system. Which workflow element should you use?

A. Commitment approval

B. Update budget balances budget register

C. Budget planning stage allocation

D. Approve budget account entry

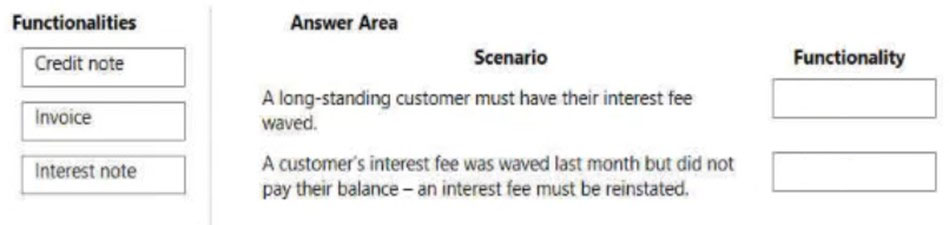

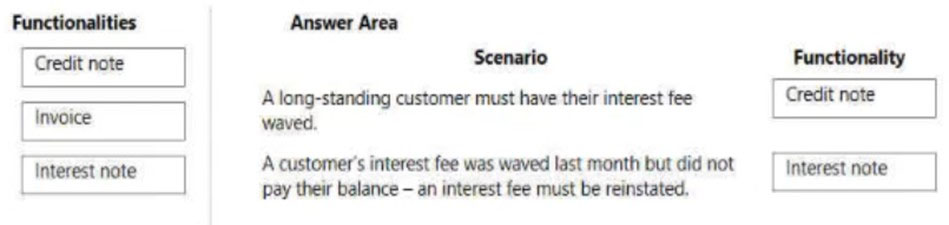

DRAG DROP - You have implemented Dynamics 365 Finance. You must implement interest fees to encourage customers to pay on time. You need to configure interest fees. Which functionality should be configured? To answer, drag the appropriate functionality to the correct scenario. Each functionality may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A company is preparing to complete yearly budgets. The company plans to use the Budget module in Dynamics 365 Finance for budget management. You need to create the new budgets. Solution: Create budget plans for multiple scenarios. Does the solution meet the goal?

A. Yes

B. No

HOTSPOT - You need to ensure Trey Research meets the compliance requirement. Which budget technology should you implement? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. the Excel budget template

B. budget codes

C. budgeting workflows

D. set-based budget processing

SIMULATION - You are a functional consultant for Contoso Entertainment System USA (USMF). USMF recently opened a new bank account in the Brazilian currency. You need to create a new bank account in the system for the new bank account. To complete this task, sign in to the Dynamics 365 portal.

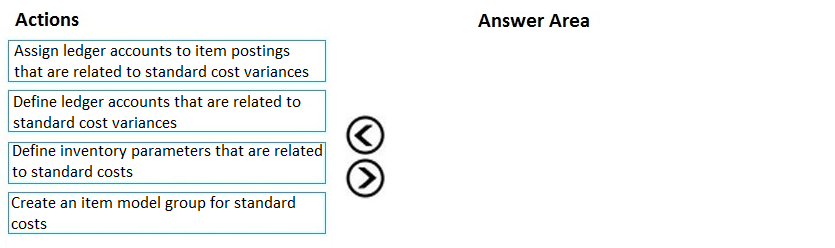

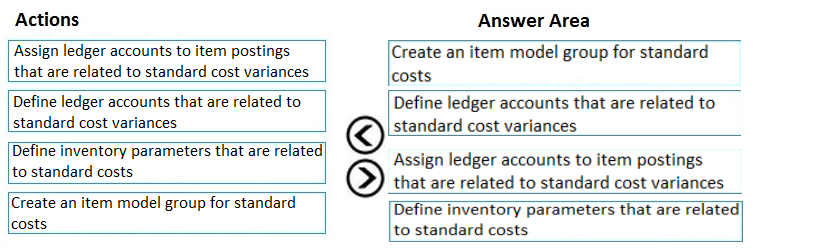

DRAG DROP - You need to set up a process of tracking, recording, and analyzing costs associated with the products or activities of a nonmanufacturing organization. You need to configure the prerequisite setup for the standard costing version for the current period. In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order. Select and Place:

A company manufactures and installs air filtering units for industrial manufacturing plants. The air filtering units are manufactured to order. The company realized the value of the sales in the following manner: • 25 percent at the time of the sale • 50 percent when the unit is shipped • 25 percent when the unit is installed Additionally, a three-year warranty is sold with each unit. Revenue for the warranty is recognized equally in each year the warranty covers. You need to configure revenue recognition. What should you do?

A. Create one revenue schedule with milestones.

B. Create a new revenue schedule for each unit.

C. Create a reallocation posting for the warranty revenue.

D. Create the revenue schedule so that it uses the contract terms.

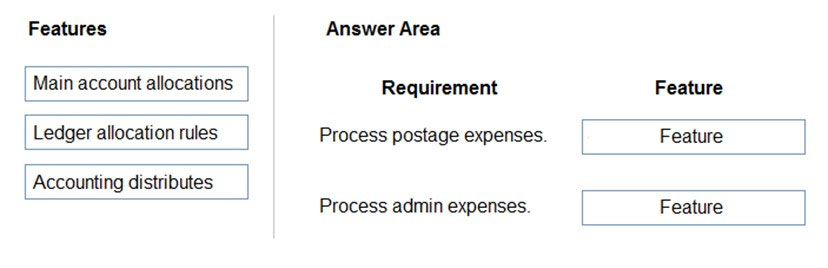

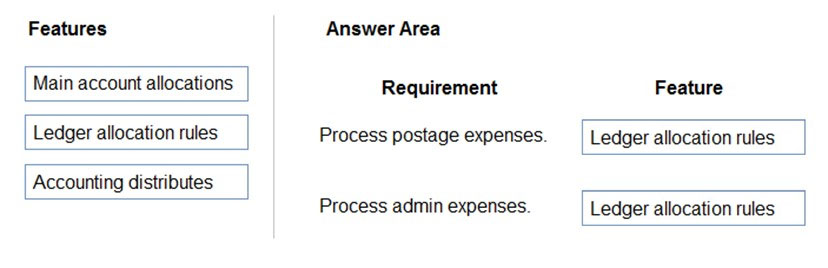

DRAG DROP - You need to process expense allocations. Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point. Select and Place:

You are using Microsoft Dynamics 365 Finance. You need to acquire a fixed asset. What are three possible ways to achieve the goal? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Use a sales invoice.

B. Select a fixed asset account type and transaction type acquisition in a general journal.

C. Select a fixed asset procurement category on the purchase order line.

D. Use a budget plan.

E. Eliminate an investment project once it is finished.

Case study - This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided. To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study. At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section. To start the case study - To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question. Background - First Up Consultants is a global engineering and consulting organization based in Atlanta. The organization assists customers with various implementation projects. The organization provides both consulting services and custom software development. First Up Consultants was recently acquired by a Canadian engineering firm that uses Dynamics 365 Finance. The firm requires First Up Consultants to transition to the solution by 2022. First Up Consultants employs consultants that travel globally, which requires extensive expense management capabilities. First Up Consultants offers software as a service (SaaS) products to customers by using monthly and quarterly subscriptions. Current environment. Travel and expense The company is currently in Phase 2 of their Dynamics 365 Finance implementation. • Consultants submit all travel receipts by using inter-office mail to the team admin for processing, but First Up Consultants wants to modernize this experience. • Expense reports are manually approved and signed by the employee’s manager. Current environment. Finance - • First Up Consultants operates on a 4-5-4 calendar. • Accounting for revenue has been difficult with the SaaS offerings. This has led to implementing Dynamics 365 Finance Revenue recognition. • Revenue recognition has been live for 3 months. • Adatum Corporation pays quarterly for use of the First Up Consultants web design application, starting from the day of use. • Fourth Coffee pays monthly for use of the First Up Consultants photograph editing application with a contract starting August 1 and payment starting September 1. • Adventure Works Cycles pays per use of the First Up Consultant video platform. • A blocking rule is set up to prevent a sales order from processing if a customer exceeds a credit limit. • Customer credit is set up at the account level for VanArsdel, Ltd. • Tailspin Toys is owned by Wingtip Toys. The companies have a credit limit of $60.000 and $100,000, respectively. Current environment. Revenue allocation The company reports the following revenue allocation percentages:Current environment. Tax - VAT tax recovery is required for eligible international business trip expenses. Bank reconciliation is manual and performed by using monthly mailed account statements. The company collects sales taxes from the following states:

Requirements - Travel and expense - • First Up Consultants requires that employees start using corporate cards for all travel expenses. • All expenses over $50 require a receipt. • Beer cannot be expensed. • Employees may use the corporate card for personal expenses during work travel, but expenses must be categorized correctly. • Client entertainment expenses totaling more than $250 must be audited. • Employees require a mobile expense experience. • Expense report entries must be validated when a transaction line is entered. • Employees require the ability to capture receipts by using a mobile device. • First Up Consultants requires the ability to reimburse employees in their paychecks for expenses incurred on personal cards. Financials - • A virtual thirteenth month is required for year-end transactions. • Each day, a validation file must go to First Up Consultants bank detailing all vendor checks paid. • Except fees, all matched transactions must clear automatically during bank reconciliation. • The accounts payable team must verify expense reports prior to posting. • Only payables are allowed to be posted to a prior period up to seven days into the new period. Issues - • User1 installed the Expense Management Service add-in and implemented the auto-match and create expense from receipt features, but the receipt images do not match the corporate card transactions. • Employee1 submits an expense report for a business trip to Europe, but the report is not visible on the expense tax recovery page. • Employees provided feedback that the system lets them know of an expense report policy violation only after the entire expense report is submitted. • Members of the finance department observe sales orders that posted into a closed period. • The finance team observed that for sales order invoice 1234, the price incorrectly posts to a revenue account when it should be deferring. • Employee2 purchased supplies for a holiday party and needs to be reimbursed. • A customer orders software licenses for the offices in Tennessee and Alabama. • Expense reports for unapproved items are posting. • VanArsdel, Ltd. exceeded its credit limit but the sales order was processed. • Tailspin Toys purchases $70,000 in custom software development. You need to address the posting of sales orders to a closed period. What should you do?

A. Permanently close the period for all modules.

B. Use a ledger calendar to update period status.

C. Permanently close the fiscal year.

D. Use a ledger calendar to update module access.

E. Divide the period.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A customer uses Dynamics 365 Finance. The customer creates a purchase order for purchase $20,000 of office furniture. You need to configure the system to ensure that the funds are reserved when the purchase order is confirmed. Solution: Configure item posting groups for purchase requisitions. Does the solution meet the goal?

A. Yes

B. No

DRAG DROP - A company that manufactures consumer electronics goods uses Microsoft Dynamics 365 Finance. You need to configure capitalization thresholds for products based on the following requirements:In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

A company uses Microsoft Dynamics 365 Finance to manage fixed assets. The company uses laptops for three years and then sells the laptops externally. You need to process laptop sales. What should you do?

A. Create a fixed asset disposal journal.

B. Use a free text invoice to record the sale.

C. Create a sales order for the sale of the asset.

D. Use an inventory movement journal to record the disposal.

HOTSPOT - You are creating a payment proposal that shows invoices that are eligible to be paid. You display the Accounts payable Payment proposal screen from the Accounts payable payment journal.Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point. Hot Area:

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen. A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions. The client has the following requirements: ✑ Only expense accounts require dimensions posted with the transactions. ✑ Users must not have the option to select dimensions for a balance sheet account. You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry. Solution: Configure one account structure for expense accounts and apply advanced rules. Does the solution meet the goal?

A. Yes

B. No

A company uses Dynamics 365 Finance. The company has decided to implement basic budgeting to track budgeted versus actual amounts. You need to configure the system to track and identify budget transactions and set up controls on budget balance updates. What should you define?

A. Budget cycle time span

B. Budget threshold

C. Budget transfer rules

D. Budget plan

Free Access Full MB-310 Practice Questions Free

Want more hands-on practice? Click here to access the full bank of MB-310 practice questions free and reinforce your understanding of all exam objectives.

We update our question sets regularly, so check back often for new and relevant content.

Good luck with your MB-310 certification journey!